MAS Gold Corp. ("MAS Gold") (TSX-V: MAS). As announced April 16, 2021 MAS Gold has been universally successful in binding arbitration with its former joint venture partner, Golden Band Resources Corp. ("GBN"). The decision gives MAS Gold 100% right and title to the Greywacke North and Preview-North properties and the significant gold resources identified on them with further exploration potential.

GBR retains a 2.5% Net Smelter Royalty (NSR), which MAS Gold has the right to purchase for $1,000,000 . The complete Arbitrator's finding is available on Sedar.

In particular, MAS now has full title to the following established resources;

- The Greywacke North deposit: an Indicated Mineral Resource of 255,500 tonnes at 9.92 g/t Au (cut-off grade of 5 grams gold/tonne) for 81,500 ounces of gold; plus an Inferred Mineral Resource of an estimated 59,130 tonnes at 7.42 g/t Au for 14,100 ounces of gold (NI 43-101 Technical Report, June 1, 2016 ).

- The North Lake deposit; an Inferred Mineral Resource of 14,110,000 t grading 0.92 g/t Au, hence 417,000 contained ounces of gold (NI 43-101 Technical Report, April 10, 2020 )

In order to further expand the resources, MAS Gold's recently completed winter drilling campaign included a total of 2,912.9 meters in 15 holes at Greywacke North on the Greywacke Lake Property and 2,501.5 meters drilled in 10 holes at North Lake on the Preview-North Lake Property. Assay results are expected mid-May 2021 . The proposed winter drilling of the Point target at Ramesland Lake was deferred due to insufficient ice build up.

Ron Netolitzky , Chairman, stated, "Now that we have completed the necessary arbitration, five years later, and established our title to the Greywacke Lake and Preview-North properties, we can proceed to a Preliminary Economic Assessment of the projects, which have been on hold for more than five years.

Upon compilation and analysis of the 2021 winter drill results, an expanded work program including drilling, metallurgical test work, a LiDAR survey will commence. Baseline environmental studies and community engagement, initiated in 2020., are ongoing. The primary focus of the planned work programs will be the advanced targets at North Lake and Greywacke North.

The goal of the company is to define the threshold values that could support production decisions centred around Greywacke North and North lake deposits. The presence and exploration of targets controlled by MAS Gold and other operators in the immediate area will be monitored with the objective of developing a hub and spoke approach to a central mill concept.

A separate phase of exploration work will proceed on MAS-held early stage targets with the objective of defining additional resource targets. This will include identified prospects as well as favorable structural settings.

We now look forward in moving all our goals and milestones forward. Further updates on those goals will be announced along with drill results over the next few weeks ."

Qualified Person

The scientific and technical information contained in this news release has been prepared, reviewed and approved by David Tupper , P.Geo. ( British Columbia ), MAS Gold's VP Exploration and a Qualified Person (QP) within the context of Canadian Securities Administrators' National Instrument 43-101; Standards of Disclosure for Mineral Projects (NI 43-101).

About MAS Gold Corp.

MAS Gold Corp. is a Canadian mineral exploration company focused on exploration projects in the prospective La Ronge Gold Belt of Saskatchewan. In the belt, MAS Gold Corp. operates four properties totaling 33, 843 hectares (83, 628 acres), including the Greywacke Lake, Preview-North, Elizabeth Lake and Henry Lake Properties extending along a total of roughly 60 kilometres of the geologically prospective La Ronge , Kisseynew and Glennie Domains that make up the La Ronge Gold Belt.

MAS Gold's holdings include the Greywacke North, North Lake and Point gold deposits and the historically drill defined Elizabeth Lake copper-silver volcanic-hosted massive sulphide deposit.

The Greywacke North deposit, which hosts multiple known stratabound, high-grade gold-bearing zones, has an estimated 255,500 tonnes at 9.92 g/t Au (cut-off grade of 5 grams gold/tonne) for 81,500 ounces of gold, plus an Inferred Mineral Resource of an estimated 59,130 tonnes at 7.42 g/t Au for 14,100 ounces of gold (NI 43-101 Technical Report, June 1, 2016 ).

The North Lake deposit located at Preview North Property is estimated to contain an Inferred Mineral Resource of 14,110,000 t grading 0.92 g/t Au, hence 417,000 contained ounces of gold (NI 43-101 Technical Report, April 10, 2020 )

MAS Gold Corp.

Jim Engdahl

President & CEO

Caution Regarding Forward-Looking Information and Statements:

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. MAS Gold cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to MAS Gold's limited operating history, the need to comply with environmental and governmental regulations, results of exploration programs on their projects and those risks and uncertainties identified in each of their annual and interim financial statements and management discussion and analysis. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, MAS Gold undertakes no obligation to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE MAS Gold Corp

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2021/21/c9819.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2021/21/c9819.html

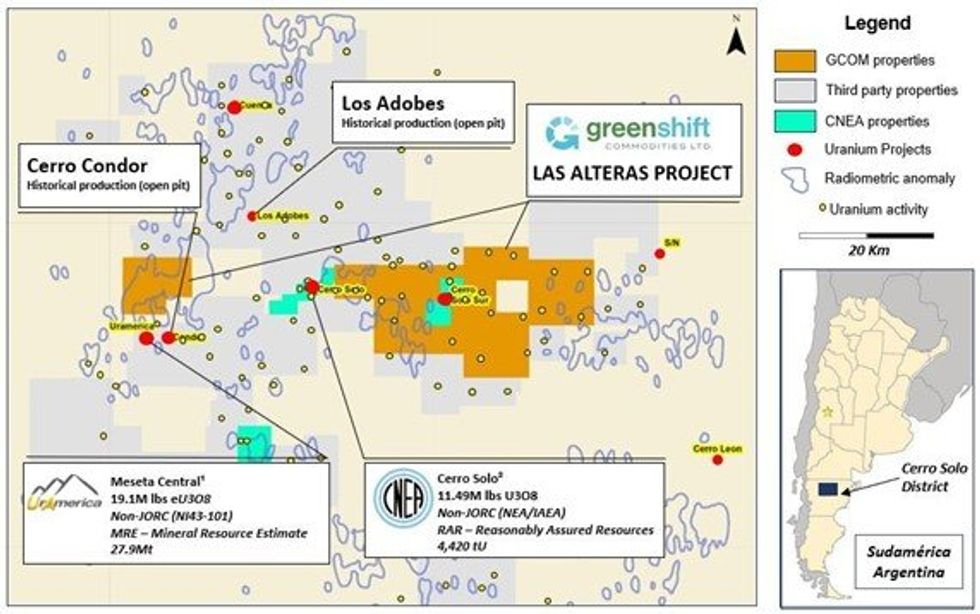

Figure 1: Location map of Las Alteras uranium project

Figure 1: Location map of Las Alteras uranium project

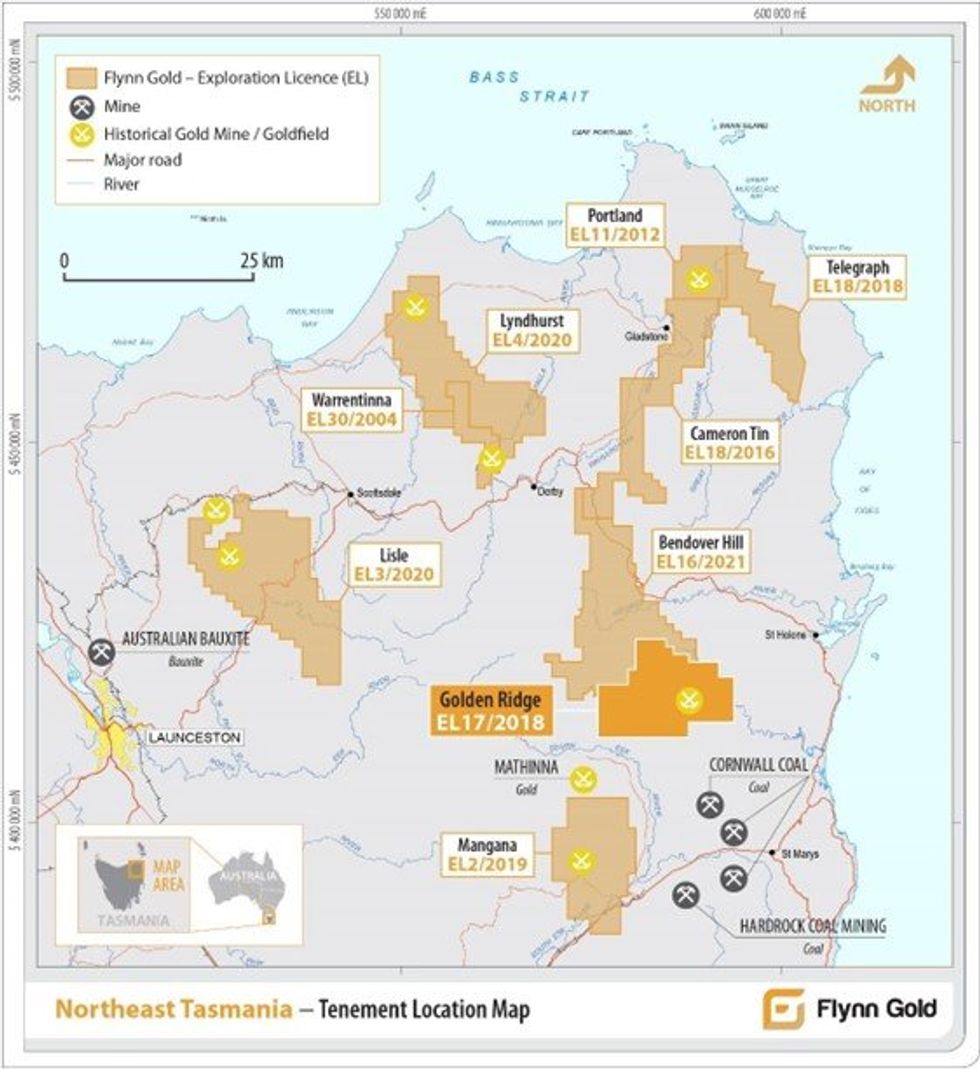

Figure 1 - Location of Flynn Gold tenements in NE Tasmania.

Figure 1 - Location of Flynn Gold tenements in NE Tasmania.