Cache Exploration Inc. (the "Company" or "Cache") (TSXV: CAY) (OTC Pinksheet: CEXPF) is pleased to announce the results from metallurgical tests from the Rusty Zone at the Kiyuk Lake gold project, Nunavut .

The previously reported intercept of 8m @ 26.4 g/t Au reported from KI17-001 from 2017 summer drilling in the Rusty zone was submitted to SGS Laboratories for metallurgical testing and screen metallics. Cache is please to report that leachwell active accelerated cyanide leach testing returned an average of 98% free gold recovery from the intercept.

Both leachwell and metallic screens yielded slightly lower Au values over the intercept of 21.5 g/t Au and 24.2 g/t Au respectively. These values are lower compared to the original 50 g fire assay results, but these lower values are considered to be more precise estimates of the Au content of the sample. Regardless, they confirm the high-grade nature of the Au intersection examined.

Jack Bal , CEO of Cache Exploration Inc , states "The 98% free gold recovery tell us the metallurgy of Kiyuk Lake is mainly free gold. This simplifies the metallurgy of the deposit and lowers the cost of recovery of Gold. We are extremely pleased with the upcoming drill program"

Table 1 Results from Leachwell and Metallic Screen tests

Sample Number | Original Au ppm | Leachwell Au ppm | Tails FA Au ppm | Total Au ppm | Free Au % | Metallic Au ppm |

A00207356 | 0.025 | 0.89 | 0.89 | 100 | 1.74 | |

A00207357 | 4.52 | 5.7 | 0.037 | 5.737 | 99 | 6.24 |

A00207358 | 103 | 73.5 | 1.82 | 75.32 | 98 | 85.1 |

A00207359 | 7.45 | 6.21 | 0.235 | 6.445 | 96 | 4.24 |

A00207361 | 1.2 | 0.71 | 0.019 | 0.729 | 97 | 1.32 |

A00207362 | 0.006 | |||||

A00207363 | 0.007 | 0.03 | 0.03 | 100 | 0.04 | |

Totals | 116.208 | 89.151 | 98.68 |

Summary of Analysis:

A 1 kg split of coarse reject material from a selected high-grade intersection was pulverized at SGS Red Lake. Approximately 400 g of this material underwent screened metallic fire assay at Red Lake using a 200 mesh (75 micron) screen, with a duplicate 50 g fire assay of the -200 mesh material (method GO FAS30k). The +200 mesh material was fire assayed in total. The assay results are weighted by the respective weights of the +200 and -200 grain size fractions to calculate a total Au value for each sample. 500 g of material was also sent to SGS in Burnaby for an active accelerated cyanide leach (Leachwell method code GE LWL69K). After tumbling for 24 hours, an organic solvent (DIBK) was added to extract the Au and the solvent analyzed using AAS. This assay gives the concentration of free Au in the sample that can be extracted using cyanide. A 50 g fire assay of the tails gives the concentration of Au that was not dissolved in the cyanide. Combined, the two values give a bulk Au assay for the 500 g sample, as well as the proportion of free to encapsulated Au in the sample for the pulverization used. In this instance nearly 100% of all Au in the sample was liberated during pulverization and was available to be taken up by the cyanide solution.

Rusty Zone

Drilling at the Rusty zone will be focused on offsetting the high-grade gold intercepts in 2017 and expanding the disseminated gold mineralization at depth and at surface to the south and east. Drilling in 2013 and 2017 demonstrated strong continuity of breccia-hosted gold mineralization within the Rusty zone.

Highlights from previous drilling at Rusty include:

- 8.0m at 26.4 g/t Au from 108m

- 52.4 m at 3.2 g/t Au from surface

- 35.9 m at 4.9 g/t Au from 134.1 m

- 61.5 m at 3.3 g/t Au from 159 m

- 122.0m at 1.8 g/t Au from 188m

Gold Point Zone & East Gold Point Discovery

The Gold Point zone is a high priority target located in a 24 kilometre magnetic anomaly coinciding with a polymictic conglomerate that will receive further drilling in this program. Ground magnetics, prospecting and mapping in 2012 and 2013 identified a possible extension of Gold Point mineralization by the discovery of similar mineralization, in boulders, in the polymictic conglomerate that hosts the Gold Point zone. These extensional zones - South Gold Point and East Gold Point respectively - were further defined by ground magnetics as zones of magnetite destruction coincident with east-west structures, which are identical to those found at the Gold Point zone. Drilling in 2017 resulted in a new discovery at East Gold Point. Drilling in 2021 will focus on expanding East Gold Point and discovery drilling at South Gold Point in addition to the expansion drilling at Gold Point.

Previous drilling at the Gold Point zone returned:

- 63.6 m at 2.84 g/t Au from 148 m

- 12 m at 2.4 g/t Au from 120 m

- 12 m at 3.9 g/t Au from 163.5 m

East Gold Point, is located 700m to the east of the Gold Point zone. This previously untested target was defined by coincidence of magnetite destructive features observed in ground magnetic data and the presence of mineralized boulders on surface. East Gold Point represents a 'proof of concept' new discovery that confirms the prospective potential of structures that cross cut the polymictic conglomerate unit. Success in intercepting significant gold mineralization in the first drill hole to target the northern most extent of this structure is a positive result for further development of gold mineralization models at the Kiyuk Lake project. The strike length of the magnetite destructive features is yet to be determined and will require further ground magnetic surveying to define and constrain their extent.

Drilling at the East Gold Point returned:

- 64.0 m at 1.46 g/t Au from 35 m

- 10 m at 6.5 g/t Au from 248 m

About Cache Exploration

Cache Exploration is focused on its Kiyuk Lake gold project in Nunavut . Kiyuk Lake is a true district play in a new gold camp, covering a majority proportion of the Proterozoic Kiyuk Basin. The property has seen 13,500 meters of drilling in 4 drill programs from 2008-2017. Gold Showings occur over 15 Km in the basin. Drilling has discovered multiple gold intercepts over 1 g/t Au in five discrete mineralized zones Rusty, Gold Point, East Gold Point, Cobalt and Amundsen. Significant expansion possible with five new target areas identified and ready for drilling. Exploration at Kiyuk Lake takes place in winter-spring (February – May) and summer-fall (June-October).

Qualified Persons

Chris Pennimpede , P. Geo., is a Qualified Person as defined by National Instrument 43-101, has reviewed and verified the technical mining information provided in this release.

For more information about Cache Exploration, please visit: www.cacheexploration.com

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/cache-exploration-returns-98-free-gold-recovery-from-leachwell-testing-from-the-kiyuk-lake-gold-project-nunavut-301198018.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/cache-exploration-returns-98-free-gold-recovery-from-leachwell-testing-from-the-kiyuk-lake-gold-project-nunavut-301198018.html

SOURCE Cache Exploration Inc.

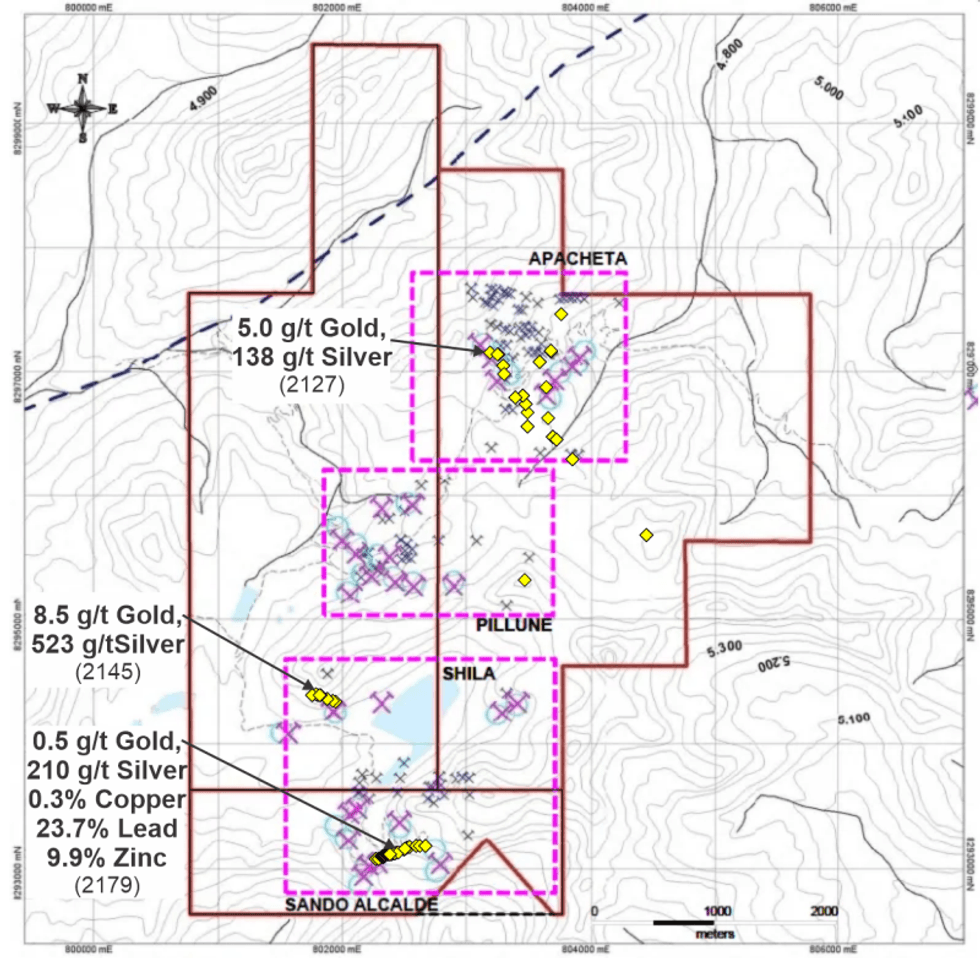

Figure 1. Fall 2023 Sample locations (yellow stars), mapped workings (crosses), with selected Samples highlighted.

Figure 1. Fall 2023 Sample locations (yellow stars), mapped workings (crosses), with selected Samples highlighted.