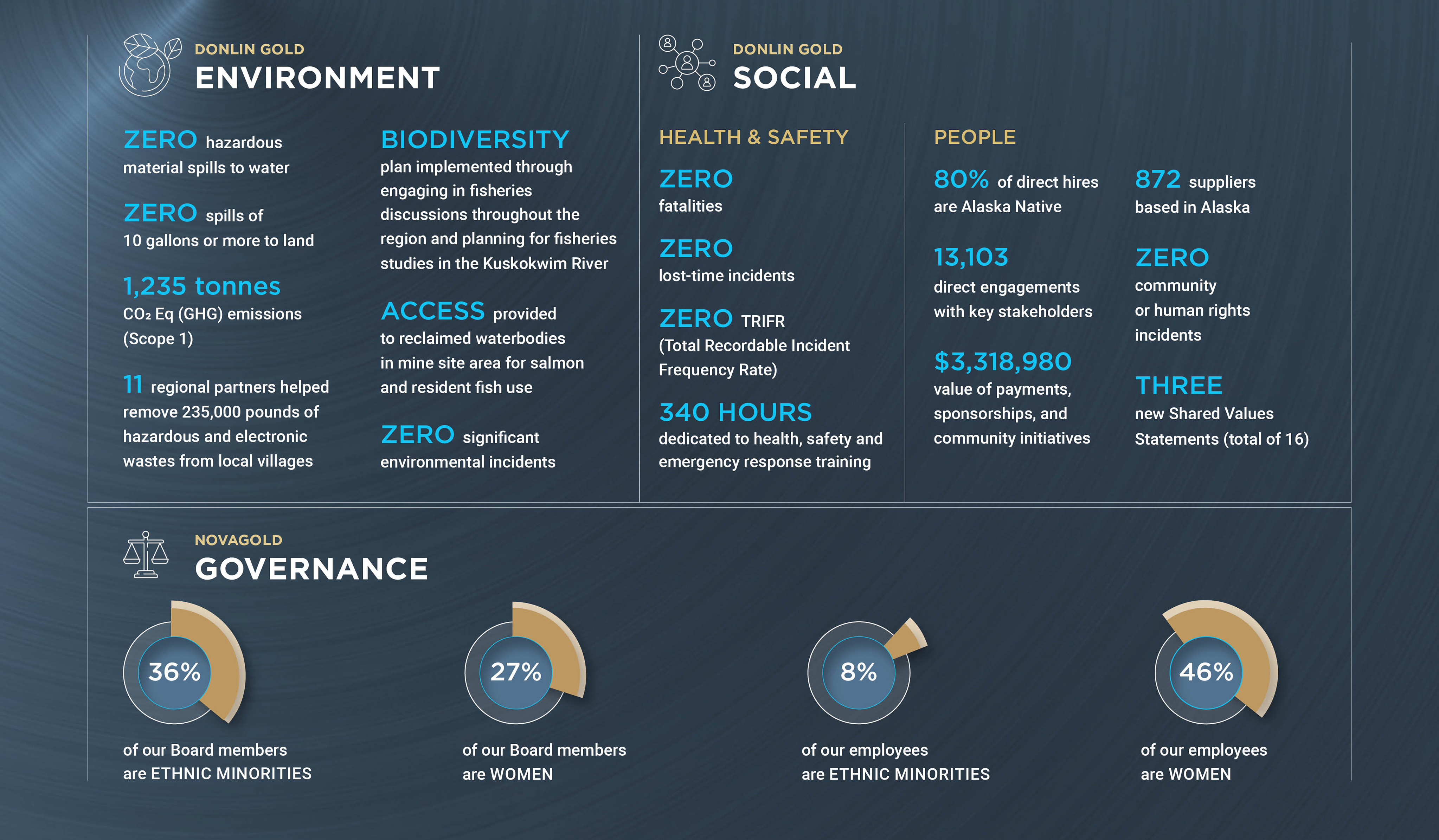

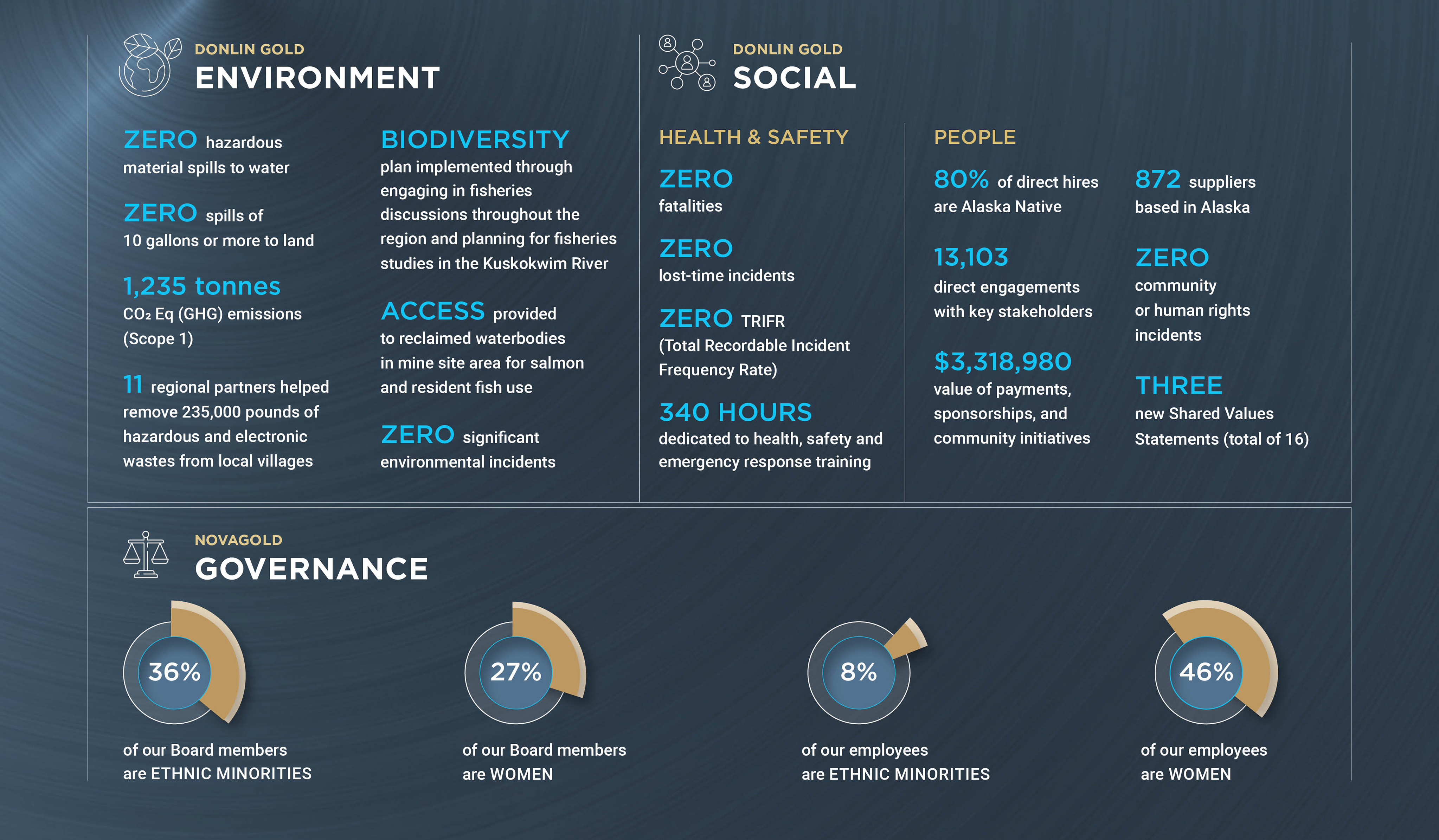

Highlights of NOVAGOLD's 2023 Sustainability Report:

As a development-stage mining company, NOVAGOLD focuses primarily on advancing the Donlin Gold project while adopting a long-term approach to sustainability. This year, the Company proudly presents its fourth annual sustainability report, aligned with the GRI framework and TCFD. Our continuous efforts to advance the Donlin Gold project toward construction and eventual operation are fortified by our strong Alaska Native Corporation partnerships with Calista and TKC. Together, our aim is to deliver economic and social benefits to the Y-K region through the environmentally responsible development of the Donlin Gold project. Emphasizing transparency, our focus is on effectively communicating sustainability priorities and ESG performance.

Central to NOVAGOLD's ethos is an unwavering focus on sustainable development, where collaboration with local communities minimizes environmental impacts, stimulates economic growth, and sets new industry benchmarks. Consistent with our commitment to transparency and sustainability, since 2020, NOVAGOLD's annual sustainability reports have highlighted the Company's significant achievements and dedication to responsible business practices and governance. Collaborative initiatives with Calista and TKC help protect the environment and provide much-needed investment in southwestern Alaska's indigenous communities.

The 2023 sustainability report is available on NOVAGOLD's website here .

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company focused on the development of its 50%-owned Donlin Gold project in Alaska, one of the safest mining jurisdictions in the world. With approximately 39 million ounces of gold in the Measured and Indicated Mineral Resource categories, inclusive of Proven and Probable Mineral Reserves (541 million tonnes at an average grade of approximately 2.24 grams per tonne, in the Measured and Indicated Resource categories on a 100% basis) 1 , the Donlin Gold project is regarded to be one of the largest, highest-grade, and most prospective known open-pit gold deposits in the world. According to the 2021 Technical Report and the S-K 1300 Report (both as defined in the footnote below), once in production, the Donlin Gold project is expected to produce an average of more than one million ounces per year over a 27-year mine life on a 100% basis. The Donlin Gold project has substantial exploration potential beyond the designed footprint of the open pit which currently covers three kilometers of an approximately eight-kilometer-long gold-bearing trend. Current activities at the Donlin Gold project are focused on state permitting, engineering studies, community outreach, and workforce development in preparation for the eventual construction and operation of this project. With a strong balance sheet, NOVAGOLD is well-positioned to fund its share of permitting and advancement efforts at the Donlin Gold project.

NOVAGOLD Contacts:

Mélanie Hennessey

Vice President, Corporate Communications

604-669-6227 or 1-866-669-6227

Frank Gagnon

Manager, Investor Relations

778-990-0299 or 1-866-669-6227

Cautionary Note Regarding Forward-Looking Statements

This media release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are frequently, but not always, identified by words such as "expects", "continue", "ongoing", "guidance", "strategy", "poised", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", "would" or "should" occur or be achieved. Forward-looking statements are based on a number of material assumptions, including but not limited to the following, which could prove to be significantly incorrect: our ability to achieve production at any of our mineral exploration and development properties; estimated capital costs, operating costs, production and economic returns; estimated metal pricing, metallurgy, mineability, marketability and operating and capital costs, together with other assumptions underlying our resource and reserve estimates; our expected ability to develop adequate infrastructure and that the cost of doing so will be reasonable; assumptions that all necessary permits and governmental approvals will be obtained and the timing of such approvals; assumptions made in the interpretation of drill results, the geology, grade and continuity of our mineral deposits; our expectations regarding demand for equipment, skilled labor and services needed for exploration and development of mineral properties; and that our activities will not be adversely disrupted or impeded by development, operating or regulatory risks. Forward-looking statements are necessarily based on several opinions, estimates and assumptions that management of NOVAGOLD considered appropriate and reasonable as of the date such statements are made, are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results, activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements. All statements, other than statements of historical fact, included herein are forward-looking statements. These forward-looking statements include statements regarding our long-term approach to sustainability; ongoing support provided to key stakeholders including Native Corporation partners; Donlin Gold's continued support for the state; the potential development and construction of the Donlin Gold project; the sufficiency of funds to continue to advance development of Donlin Gold, including to a construction decision; perceived merit of properties; mineral reserve and mineral resource estimates; Donlin Gold's ability to secure the permits needed to construct and operate the Donlin Gold project in a timely manner, if at all; whether the Donlin Gold LLC board will continue to advance the Donlin Gold project up the value chain; the success of the Donlin Gold community relations plan; and the outcome of exploration drilling at the Donlin Gold project and the timing thereof;. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements are not historical facts but instead represent the expectations of NOVAGOLD management's estimates and projections regarding future events or circumstances on the date the statements are made. Important factors that could cause actual results to differ materially from expectations include the need to obtain additional permits and governmental approvals; the timing and likelihood of obtaining and maintaining permits necessary to construct and operate; the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; lingering effects of COVID-19; uncertainties involved in the interpretation of drill results and geological tests and the estimation of reserves and resources; changes in mineral production performance, exploitation and exploration successes; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in the United States or Canada; the need for continued cooperation between Barrick Gold Corporation and NOVAGOLD for the continued exploration; the need for additional capital if NOVAGOLD determined to proceed with an updated feasibility study on its own; development and eventual construction of the Donlin Gold property; the need for cooperation of government agencies and Native groups in the development and operation of properties; risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, disease pandemics, non-compliance with environmental and permit requirements, unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases, which could include significant increases in estimated capital and operating costs; fluctuations in metal prices and currency exchange rates; whether or when a positive construction decision will be made regarding the Donlin Gold project; and other risks and uncertainties disclosed in NOVAGOLD's most recent reports on Forms 10-K and 10-Q, particularly the "Risk Factors" sections of those reports and other documents filed by NOVAGOLD with applicable securities regulatory authorities from time to time. Copies of these filings may be obtained by visiting NOVAGOLD's website at www.novagold.com, or the SEC's website at www.sec.gov, or on SEDAR+ at www.sedarplus.ca. The forward-looking statements contained herein reflect the beliefs, opinions and projections of NOVAGOLD on the date the statements are made. NOVAGOLD assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

_____________________________________________________

1 Donlin Gold data as per the report titled "NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA" with an effective date of June 1, 2021 (the "2021 Technical Report") and the report titled "S-K 1300 Technical Report Summary on the Donlin Gold Project, Alaska, USA" (the "S-K 1300 Report"), dated November 30, 2021. Donlin Gold possesses Measured Resources of approximately 8 Mt grading 2.52 g/t and Indicated Resources of approximately 534 Mt grading 2.24 g/t, each on a 100% basis and inclusive of Mineral Reserves, of which approximately 4 Mt of Measured Resources and approximately 267 Mt of Indicated Resources inclusive of Reserves is attributable to NOVAGOLD through its 50% ownership interest in Donlin Gold LLC. Exclusive of Mineral Reserves, Donlin Gold possesses Measured Resources of approximately 1 Mt grading 2.23 g/t and Indicated Resources of approximately 69 Mt grading 2.44 g/t, of which approximately 0.5 Mt of Measured Resources and approximately 35 Mt of Indicated Resources exclusive of Mineral Reserves is attributable to NOVAGOLD. Donlin Gold possesses Proven Reserves of approximately 8 Mt grading 2.32 g/t and Probable Reserves of approximately 497 Mt grading 2.08 g/t, each on a 100% basis, of which approximately 4 Mt of Proven Reserves and approximately 249 Mt of Probable Reserves is attributable to NOVAGOLD. Mineral Reserves and Resources have been estimated in accordance with NI 43-101 and S-K 1300.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/dfef9e75-dcf4-4f66-b621-9a0b379a64a0