Magna Mining Inc. (TSXV: NICU) ("Magna" or the "Company") is pleased to announce drill results for the first two drill holes at its Shakespeare Project, located near Sudbury, Ontario. Diamond drilling on the Shakespeare Project commenced in late April, with one diamond drill focused on better defining the area between the East and West zones, referred to as the Gap Zone, and at depth, below the East Zone.

Drillhole MMC-21-15 intersected 0.51% Nickel Equivalent ("Ni Eq") over 33.8 metres in the Gap Zone, thereby supporting the Company's thesis that the existing NI 43-101 Mineral Resource estimate can be expanded in this near-surface part of the Shakespeare deposit.

Jason Jessup, Chief Executive Officer of Magna, stated, "We are pleased to report the first assay results received from our ongoing exploration program on the Shakespeare Project. Results from hole MMC-21-15 demonstrate the near surface exploration potential of the project, as well as the potential to significantly increase Mineral Resources."

"Of the planned 9,000 metre diamond drilling program to date, we have completed 2,426 metres in 11 drillholes. Additionally, we have successfully progressed three of the 2021 exploration program objectives. Firstly, drilling to date has advanced our understanding of the geological controls on Shakespeare mineralization. In addition, we have now identified substantial nickel-copper-PGM mineralization in proximity to our open pit resource and have established platforms for downhole geophysical surveys, which will help guide additional drilling in 2021. We are encouraged by the results to date, including drillhole MMC-21-15, which intersected significant mineralization outside of the current Mineral Resource and extending outside of the 2021 open pit resource shell. Magna looks forward to providing additional updates as the 2021 exploration program progresses and assay results are received," stated Jason Jessup.

The Gap Zone currently separates the Shakespeare West and East mineral resources (Figure 1). Six drillholes targeted the Gap Zone area, and results have been received for two holes. Table 1 summarizes drilling and assays received to date. Significant results include drillhole MMC-21-15, which intersected a wide interval of mineralization, extending beyond the current mineral resource open pit shell (Figure 2).

Two drill holes, MMC-21-18 and MMC-18-07 extension, were completed beneath the East Zone and extended into the footwall of the known deposit. These will provide platforms for downhole geophysical surveys, which could potentially define geophysical anomalies representing areas of conductivity and mineralization. Crone Geophysics has completed surveys on 5 of the 11 holes, for which results are pending.

Drilling has also been carried out on regional targets while the geophysical surveying program was being executed at Shakespeare. Currently the drill is on our Springer Target which is following up on surface sampling that assays up to 7.36% Cu and is in proximity to our newly acquired patents claims (see press release dated June 8th, 2021). Drilling will resume on the Shakespeare deposit later this month.

Figure 1: Shakespeare Deposit longitudinal section, illustrating the location of diamond drilling and assay results received to date

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/8002/88549_96082a0c64487b4b_002full.jpg

Figure 2: Vertical section illustrating drillhole MMC-21-15

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/8002/88549_96082a0c64487b4b_003full.jpg

Table 1 2021 Diamond Drilling Results

| DDH | Depth (m) | Zone | Including | From (m) | To (m) | Length (m) | Cu (%) | Ni (%) | Co (%) | Pt (g/t) | Pd (g/t) | Au (g/t) | Ni Eq |

| MMC-21-14 | 178 | Gap | 63.0 | 65.0 | 2.0 | 0.08 | 0.13 | 0.01 | 0.15 | 0.16 | 0.08 | 0.21 | |

| MMC-21-15 | 201 | Gap | 49.8 | 52.6 | 2.8 | 0.01 | 0.27 | 0.00 | 0.01 | 0.00 | 0.00 | 0.23 | |

| Gap | and | 90.5 | 124.3 | 33.8 | 0.31 | 0.27 | 0.02 | 0.26 | 0.34 | 0.19 | 0.51 | ||

| Including | 90.5 | 112.2 | 21.6 | 0.37 | 0.34 | 0.03 | 0.32 | 0.42 | 0.24 | 0.64 | |||

| East FW | 131.9 | 134.7 | 2.8 | 0.51 | 0.39 | 0.02 | 0.45 | 0.49 | 0.25 | 0.73 | |||

| MMC-21-16 | 309 | S-13 | Assays Pending | ||||||||||

| MMC-21-17 | 150 | Gap | Assays Pending | ||||||||||

| MMC-21-18 | 426 | East FW | Assays Pending | ||||||||||

| MMC-21-19 | 252 | Gap | Assays Pending | ||||||||||

| MMC-21-20 | 126 | Gap | Assays Pending | ||||||||||

| MMC-18-07 (Deepening) | 600 175 ext | East FW | Assays Pending | ||||||||||

| MSP-21-01 | 102 | Springer | Assays Pending | ||||||||||

| MSP-21-02 | 351 | Springer | Assays Pending | ||||||||||

| MSP-21-03 | 71 | Springer | Assays Pending | ||||||||||

(1) Reported lengths are downhole length. True widths are estimated to be 70-80% of downhole length.

(2) Nickel Equivalent grade is calculated based on metal prices of $6.25/lb Ni, $2.80/lb Cu, $31.00/lb Co, $950/oz Pt, $900/oz Pd and $1,250.00/oz Au, and metal recoveries of 76.4% for Ni, 95.9% for copper, 71% for Co, 74.8% for Pt, 42.4% for Pd and 38.4% for Au.

Qualified Person

The technical information in this press release has been reviewed and approved by Marshall Hall, M.Sc., P.Geo, the Company's Exploration Manager. Mr Hall is a qualified person under Canadian National Instrument 43-101.

QA/QC

Sample QA/QC practices for Magna have been designed to meet or exceed industry standards. Drill core is collected from the diamond drill and placed in sealed core trays from transport to Magna's core facilities. The core is then logged and samples marked in intervals of up to 1.5m and cut with a diamond saw. Samples are then bagged in plastic bags with 10 bagged samples being placed into rice bags for transport to SGS Laboratories, Sudbury. Samples are submitted in batches of 50 with 5 QA/QC samples including, 2 certified reference material standards, 2 samples of blank material and 1 duplicate. The current drilling program is being carried out under the supervision of Marshall Hall, M.Sc., P.Geo, the Company's Exploration Manager.

About Magna Mining Inc.

Magna Mining is an exploration and development company focused on nickel, copper and PGM projects in the Sudbury Region of Ontario, Canada. The Company's flagship asset is the past producing Shakespeare Mine which has major permits for the construction of a 4500 tonne per day open pit mine, processing plant and tailings storage facility and is surrounded by a contiguous 180km2 prospective land package. Additional information about the Company is available on SEDAR (www.sedar.com) and on the Company's website (www.magnamining.com).

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Senior Vice President

Email: info@magnamining.com

Cautionary Statement

This press release contains certain forward-looking information or forward-looking statements as defined in applicable securities laws. Forward-looking statements are not historical facts and are subject to several risks and uncertainties beyond the Company's control, including statements regarding plans to complete exploration programs, potential mineralization, exploration results and statements regarding beliefs, plans, expectations or intentions of the Company. Resource exploration and development is highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/88549

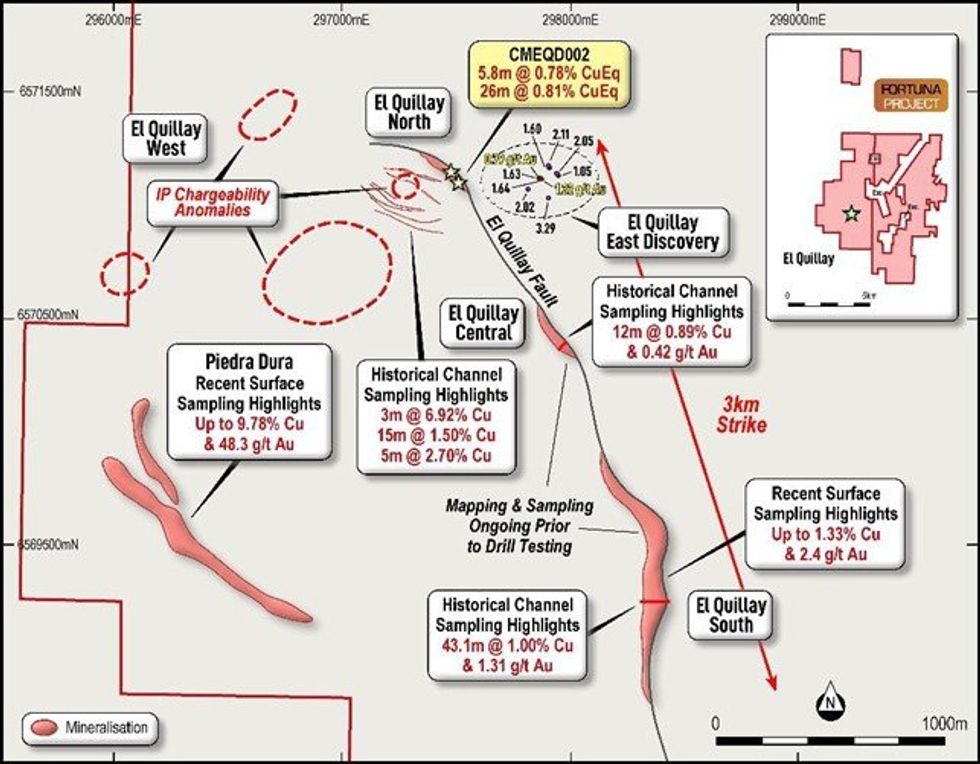

Figure 1: Plan view of El Quillay copper trend, showing multiple zones of potential parallel mineralisation

Figure 1: Plan view of El Quillay copper trend, showing multiple zones of potential parallel mineralisation