TSX Venture Exchange: NEV

Nevada Sunrise Gold Corp. ("Nevada Sunrise", or the " Company ") (TSXV: NEV) (OTC: NVSGF) is pleased to announce that the Nevada Division of Water Resources ("NDWR") has granted a one-year extension of time for the Company's Nevada water right Permit 44411 (the "Permit"). The Permit is owned by a subsidiary company of Nevada Sunrise and is currently the subject of a purchase and sale agreement with Cypress Development Corp. of Vancouver, BC Canada (TSXV: CYP) (OTCQB: CYDVF) (Frankfurt: C1Z1) ("Cypress").

The extension of time granted by the NDWR to August 28, 2022 supports a successful closing of the purchase of the Permit by Cypress, projected to occur in December 2021 (the "Transaction"). The Permit allows for the beneficial use of 1,770 acre/feet of water for mining, milling and domestic use per year and will form an essential component of Cypress' plans for the development of a new lithium mine in Esmeralda County .

The agreed purchase price for the Permit is US$3.0 million to be paid in a combination of cash and Cypress' common shares (see Nevada Sunrise news release dated May 10, 2021 ). The purchase price includes an initial non-refundable cash payment of US$150,000 (paid), and a final payment of US$2.85 million on receipt of all necessary approvals and transfer of the Permit to Cypress (the "Closing Payment"). The Closing Payment comprises US$2.0 million in cash and the issuance of Cypress' common shares to the value of US$850,000 (the "Share Issuance").

The Agreement is subject to terms and conditions customary for a transaction of this nature, including TSX Venture Exchange approval of the Share Issuance. Net proceeds received by the Company from the Transaction upon closing will be used to retire legal liabilities totaling approximately US$500,000 incurred during the water rights litigation from 2016 to 2019 (see Nevada Sunrise news releases dated May 16, 2016 and September 30, 2019 ), and payment of the balance owing to the underlying vendor of the Permit of approximately US$800,000 (for details of the Company's purchase of the Permit see Nevada Sunrise news release dated March 21 , 2016).

About the Permit

Nevada Sunrise, through its wholly-owned Nevada subsidiary company, Intor Resources Corporation ("Intor"), acquired the Permit from an underlying vendor in 2016. The Permit represents the largest volume of permitted water available in the Clayton Valley, which is a fully-appropriated hydrogeographic basin. With the exception of a single limited use permit, the NDWR has maintained that no new water is available within the Clayton Valley basin for appropriation. Nevada Sunrise has successfully defended the validity of the Permit in recent years, including negotiating a 2019 settlement agreement with Albemarle Corporation.

About Nevada Sunrise

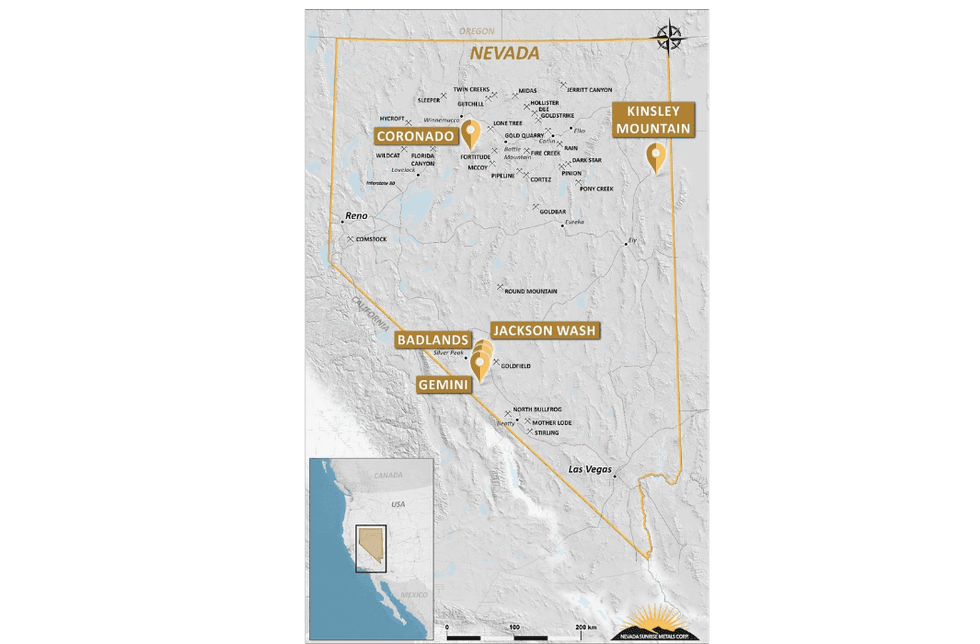

Nevada Sunrise is a junior mineral exploration company with a strong technical team based in Vancouver, BC , Canada , that holds interests in gold, copper, cobalt and lithium exploration projects located in the State of Nevada, USA .

The Company's key gold asset is a 20.01% interest in a joint venture with New Placer Dome Gold Corp. (TSXV: NGLD) at the Kinsley Mountain Gold Project ("Kinsley Mountain") near Wendover where an extensive exploration program, including drilling and ground geophysics, concluded in late November 2020 . Kinsley Mountain is a Carlin-style gold project hosting a National Instrument 43-101 compliant gold resource consisting of 418,000 indicated ounces of gold grading 2.63 g/t Au (4.95 million tonnes), and 117,000 inferred ounces of gold averaging 1.51 g/t Au (2.44 million tonnes), at cut-off grades ranging from 0.2 to 2.0 g/t Au 1 .

1 Technical Report on the Kinsley Project, Elko County, Nevada, U.S.A., dated June 21, 2021 with an effective date of May 5, 2021 and prepared by Michael M. Gustin, Ph.D., and Gary L. Simmons, MMSA and filed under New Placer Dome Gold Corp.'s Issuer Profile on SEDAR ( www.sedar.com ). |

Nevada Sunrise has right to earn a 100% interest in the Coronado VMS Project, located approximately 48 kilometers (30 miles) southeast of Winnemucca . The Company owns a 15% interest in the historic Lovelock Cobalt Mine and the Treasure Box copper properties, each located approximately 150 kilometers (100 miles) east of Reno , with Global Energy Metals Corp. (TSXV: GEMC) holding an 85% participating interest.

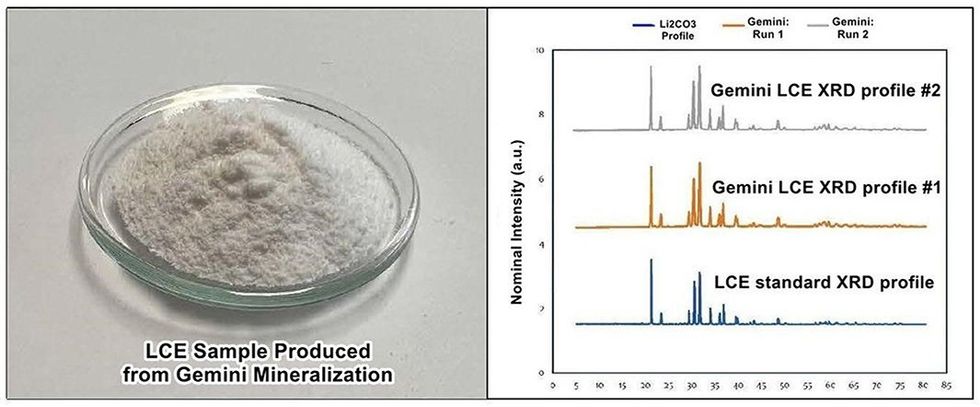

Nevada Sunrise owns 100% interests in the Jackson Wash and Gemini lithium projects, both of which are located in Esmeralda County . The Company owns Nevada water right Permit 44411, located within the Clayton Valley basin near Silver Peak, Nevada , and water permit 86863, located in the Lida Valley basin, near Lida, Nevada .

FORWARD LOOKING STATEMENTS

All statements in this release, other than statements of historical fact, are "forward-looking information" with respect to Nevada Sunrise within the meaning of applicable Canadian securities laws, including statements that address the potential sale of the Company's water rights, and the potential for future development of a lithium resource and mineral production by Cypress. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of Nevada Sunrise to differ materially from those anticipated in such forward-looking information.

Such factors include, among others, risks related to the potential sale of the Company's water rights (the "Transaction"), reliance on technical information provided by third parties on the Company's water rights or on Cypress' Clayton Valley lithium project, including access to historical information on exploration, current exploration and development activities; changes in Cypress' project parameters as its plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; labor disputes and other risks of the mining industry; delays due to pandemic; delays in obtaining governmental approvals, financing or in the completion of the Transaction, as well as those factors discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for the Nine Months Ended June 30, 2021 , which is available under Company's SEDAR profile at www.sedar.com .

Although Nevada Sunrise has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Nevada Sunrise disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking information.

Forward-looking statements are made as of the date hereof and accordingly are subject to change after such date. Except as otherwise indicated by Nevada Sunrise, these statements do not reflect the potential impact of any non-recurring or other special items or of any dispositions, monetizations, mergers, acquisitions, other business combinations or other transactions that may be announced or that may occur after the date hereof. Forward-looking statements are provided for the purpose of providing information about management's current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Nevada Sunrise does not undertake to update any forward-looking statements that are included in this document, except in accordance with applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this release. The Securities of Nevada Sunrise Gold Corporation have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to the account or benefit of any U.S. person.

SOURCE Nevada Sunrise Gold Corporation

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2021/03/c2807.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2021/03/c2807.html