What has spurred Bitcoin's price movements in recent years, and why is it back up now? Read on to find out.

What is Bitcoin?

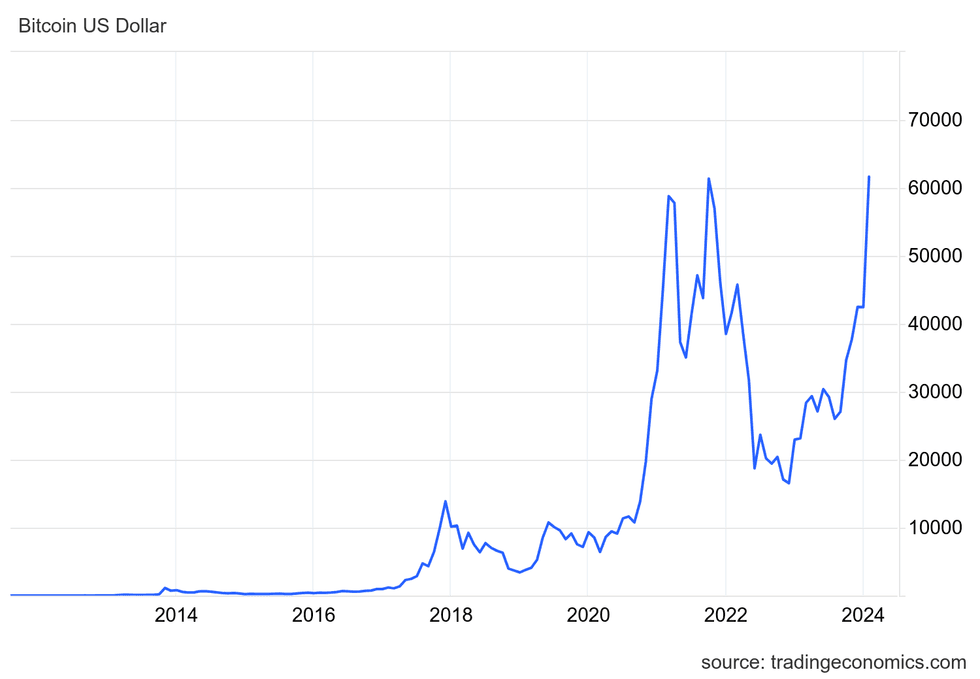

Created to counter the 2008 financial crisis, Bitcoin has weathered extreme volatility, spiking to US$19,650 in 2017 before spending years locked below US$10,000. The cryptocurrency was unveiled in late 2008 with the goal of revolutionizing the monetary system, and was first introduced in a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

The nine page manifesto was penned by a notoriously elusive person (or persons) who used the pseudonym Satoshi Nakamoto, and it lays out a compelling argument and groundwork for the creation of a cyber-currency.

Cryptographically secured, the peer-to-peer electronic payment system was designed to be transparent and resistant to censorship, using the power of blockchain technology to create an immutable ledger preventing double spending. The true allure for Bitcoin’s early adopters was in its potential to wrestle power away from banks and financial institutes and give it to the masses.

This was especially enticing as the fallout from the 2008 financial collapse ricocheted internationally. Described as the worst financial crisis since the Great Depression, US$7.4 billion in value was erased from the US stock market in 11 months, while the global economy shrank by an estimated US$2 trillion.

How many Bitcoins are there?

Unlike traditional currencies that can increase circulation through printing, the number of Bitcoins is finite. There are 21 million in existence, of which 19,144,112 are in circulation, leaving just under 2 million to be mined.

This limit is a core function of Bitcoin's algorithm, and was designed to offset inflation by maintaining scarcity.

A new Bitcoin is created when a Bitcoin miner uses highly specialized software to complete a block of transaction verifications on the Bitcoin blockchain. Roughly 900 Bitcoins are currently mined per day; however, after 210,000 blocks are completed, the Bitcoin protocol automatically reduces the number of new coins issued by half.

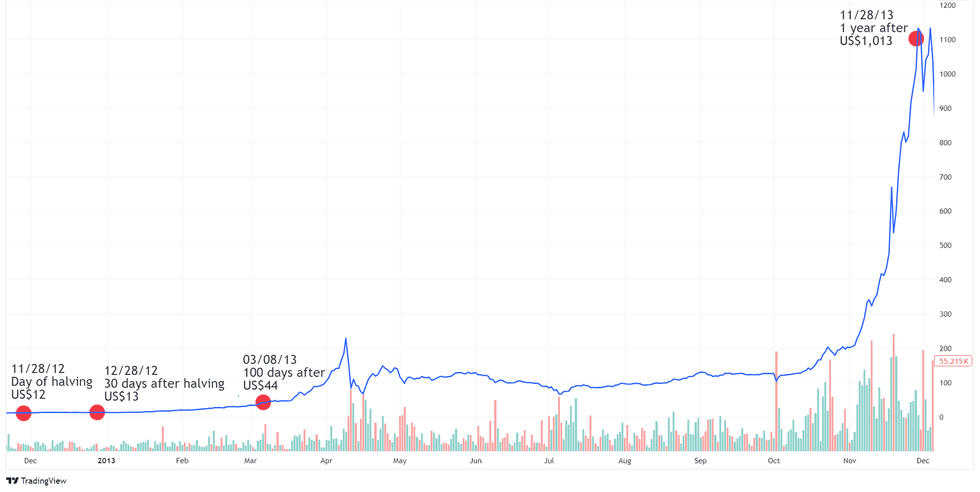

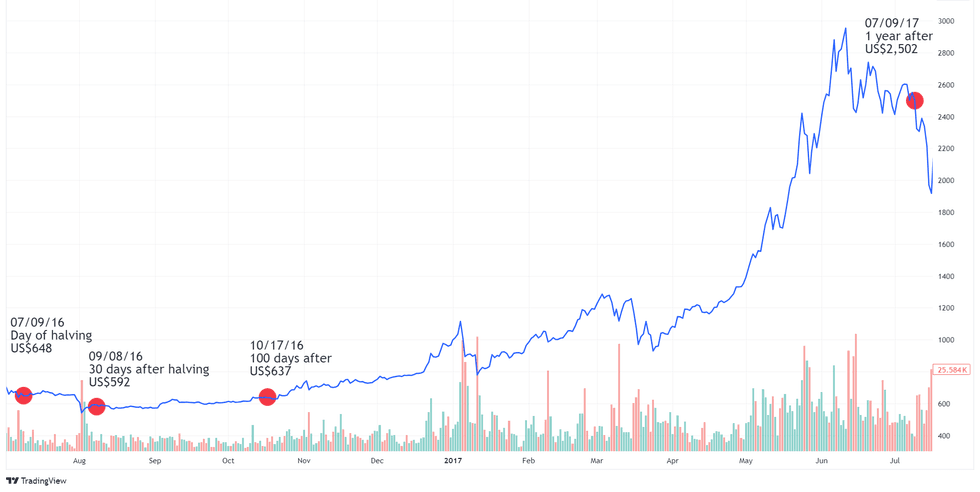

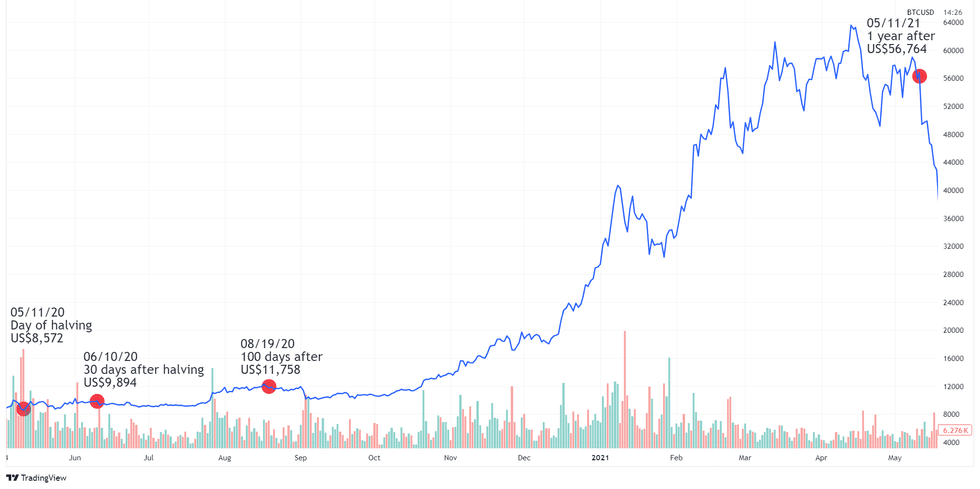

Halvings have occurred every four years since 2012, with the most recent happening in May 2020. The next halving is set to take place in mid to late April 2024.

Halving not only counteracts inflation, but also supports the cryptocurrency’s value by ensuring that its price will increase if demand remains the same.

At the moment, miners are paid 6.25 Bitcoin for every block they complete. After the April 2024 halving, the pay rate will lower to 3.125 Bitcoin for every completed block for the next four years.

How did COVID-19 affect the Bitcoin price?

January 1, 2016, marked the beginning of Bitcoin’s sustained price rise. It started the year at US$433 and ended it at US$959 — a 121 percent value increase in 12 months.

The next year brought the mainstream adoption of Bitcoin. Between January and December 2017, additional attention, the introduction of new cryptocurrencies and coverage from mainstream financial media added 1,729 percent to the crypto-coin’s value — it rose from US$1,035.24 in January to US$18,940.57 in December.

This record-setting threshold was unsustainable, and Bitcoin fell victim to its own volatility, which steadily eroded its previous gains. Despite that decrease in value, the virtual currency still held above US$3,190, a low it has not hit again since that time.

Since launching in 2008, opponents of Bitcoin have used its short history to defend their hesitance. Questions have arisen around how Bitcoin would perform during a financial crisis or recession, as the coin is extremely susceptible to uncertainty.

2020 proved a testing ground for the digital coin’s ability to weather financial upheaval. Starting the year at US$6,950.56, a widespread selloff in March brought its value to US$4,841.67 — a 30 percent decline.

The low created a buying opportunity that helped Bitcoin gain back its losses by May. Like safe-haven metal gold, Bitcoin began to emerge as a protective asset for the Millennial and Generation Z crowd. The rally continued throughout 2020, and the digital asset ended the year at US$29,402.64, a 323 percent year-over-year increase and a 507 percent rise from its March drop.

By comparison, gold, one of the best-performing commodities of 2020, added 38 percent to its value from the low in March through December, setting what was then an all-time high of US$2,060 per ounce in August.

What was the highest price for Bitcoin?

Bitcoin’s ascent continued in 2021, rallying to an all-time high of US$68,649.05 in November, a 98.82 percent increase from January. The digital asset shed some of its value to end the year at US$47,897.16 — still a 62 percent year-over-year increase.

So what led to this all-time high? A few different factors acted as price catalysts.

Much of the growth in 2021 was attributed to risk-on investor appetite, as well as Tesla’s (NASDAQ:TSLA) purchase of US$1.5 billion worth of Bitcoin. Activity was further compounded when Tesla reported plans to begin accepting Bitcoin as payment for its electric vehicles. However, following some criticism from investors and environmentalists, the electric car maker announced in 2021 that it would be conducting due diligence on the amount of renewable energy used to mine the cryptocurrency before allowing customers to buy cars with it; however, the option may be back on the table as Musk said in September of 2023 that the level of renewable energy use in the crypto industry had reached an appropriate threshold.

Increased money printing in response to the pandemic also benefited Bitcoin, as investors with more capital looked to diversify their portfolios. The success of the world’s first cryptocurrency amid the market ups and downs of 2020 and 2021 led to more interest and investment in other coins and digital assets as well. For example, 2021 saw the rise of the non-fungible token (NFT). Utilizing blockchain technology, NFTs are unique crypto assets that are stored, sold and traded digitally.

The NFT concept is largely used for art and other digital mediums to allow buyers to own a specific asset. It is estimated that the NFT market grew to more than US$40 billion in 2021, driven exclusively by cryptocurrencies, the only form of payment for NFTs. Although by November 2023, the NFT market value had fallen dramatically down to US$7.39 billion, as of February 28, 2024 that figure stands at a whopping US$58.71 billion.

Bitcoin’s mainstream usage may be a continued price catalyst as more businesses accept the digital token as payment; the growing market for digital assets could also add momentum for the cryptocurrency space.

What is Bitcoin at today?

While notoriety has catapulted the first digital currency to all-time highs, the primary headwind for the crypto coin is its frequent volatility, which has been on full display since 2021. Market uncertainty weighed especially heavily on Bitcoin in 2022. During the second quarter of that year, values dived below US$20,000 for the first time since December 2020. By the end of 2022, prices for Bitcoin had moved even lower to settle below US$17,500 BTC.

Despite its drop from the massive price highs seen in the past, Bitcoin's potential powerful performance cannot be understated as evidenced by its price performance over in 2023 and so far in 2024.

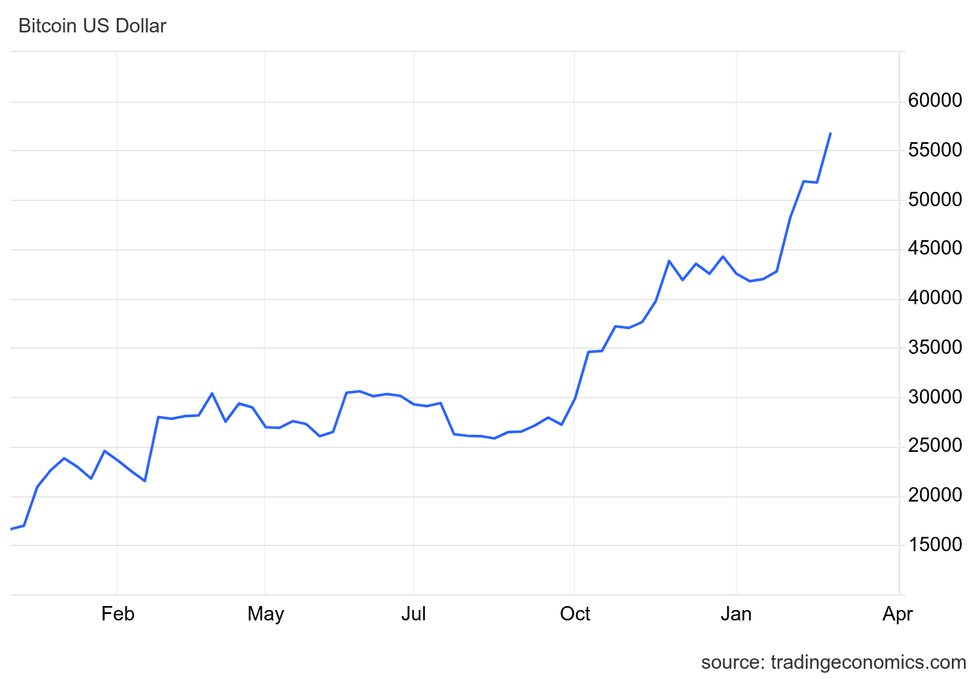

2023 started on a bright note for the price of Bitcoin, as it rallied in March to US$28,211 by March 21 after the failure of multiple US banks alarmed investors.

In Q2 2023, Bitcoin continued its ascent, stabilizing above US$25,000 even as the SEC filed lawsuits against Coinbase Global (NASDAQ:COIN), along with Binance and its founder Changpeng Zhao.

Although it looked like bad news for the sector, Bitcoin stayed steady, holding above US$25,000. This was supported by BlackRock (NYSE:BLK) filing for a Bitcoin exchange-traded fund with the SEC on June 15. Although the SEC hadn't approved applications for spot Bitcoin ETFs previously, the support from BlackRock, which is the world's largest asset manager, proved bullish.

Bitcoin's price jumped above US$30,000 on June 21, and on July 3, the crypto hit its highest price since May 2022 at US$31,500. It held above US$30,000 for nearly a month before dropping just below on July 16. By September 11, prices had slid further to US$25,150.

Bitcoin price in US dollars, January 1, 2023 to February 29, 2024.

Chart via TradingEconomics.com.

Heading into the final months of the year, the Bitcoin price benefited from increased institutional investment on the prospect of the US Securities Exchange Commission (SEC) approving a bevy of spot Bitcoin exchange-traded funds by early 2024. In mid-November the price for the popular cryptocurrency was trading up at US$37,885, and by the end of the year that figure had risen further to US$42,228 per BTC.

Once the SEC’s approval of 11 spot Bitcoin ETFs hit the wires, the price per coin jumped again to US$46,620 on January 10, 2024. These investment vehicles are continuing to drive new demand for crypto, and are a major driving force behind the more than 42 percent rise in value for Bitcoin in February, reaching US$61,113 per BTC on the last day of the month.

"Bitcoin is being driven by the support of consistent inflows into the new spot ETFs and outlook for April's halving event and June's Fed interest rate cuts," Ben Laidler, global markets strategist at retail investment platform eToro, told Reuters.

FAQs for investing in Bitcoin

What is a blockchain?

A blockchain is a digitized and decentralized public ledger of all cryptocurrency transactions.

Blockchains are constantly growing as completed blocks are recorded and added in chronological order. The mechanism by which digital currencies are mined, blockchain has become a popular investment space as the technology is increasingly being implemented in business processes across a variety of industries. These include banking, cybersecurity, networking, supply chain management, the Internet of Things, online music, healthcare and insurance.

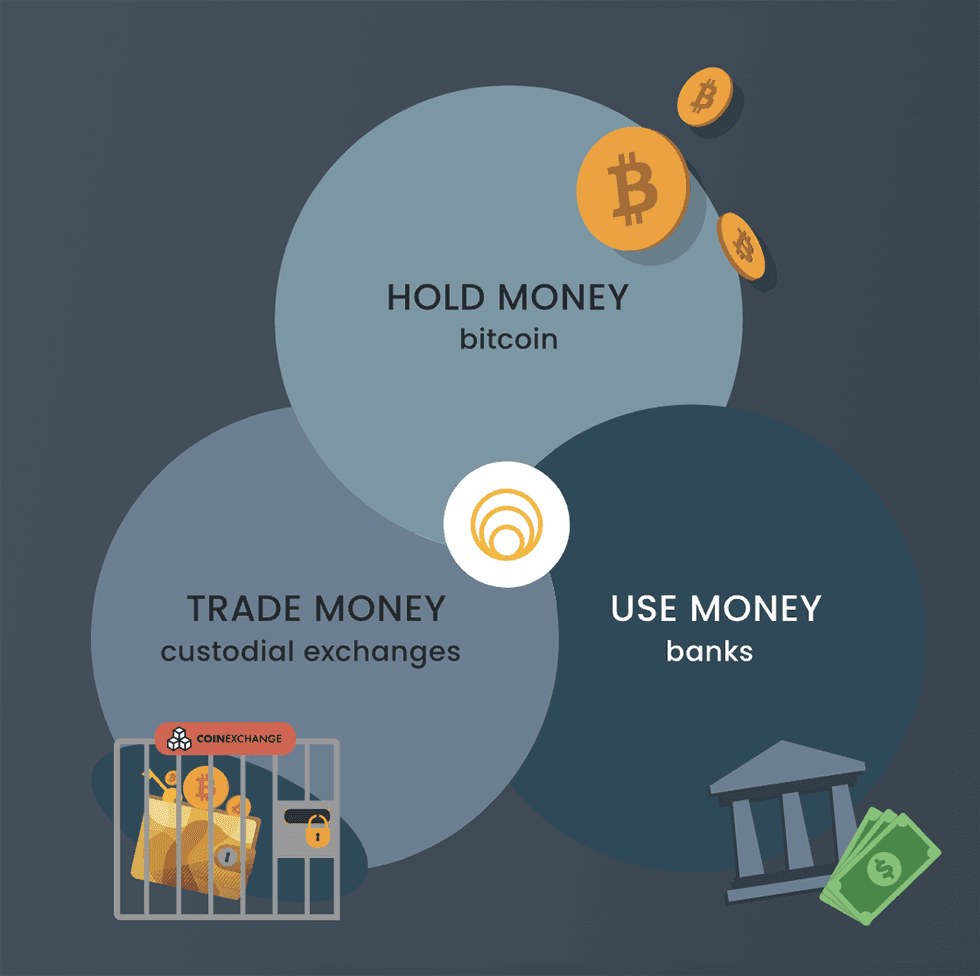

How to buy Bitcoin?

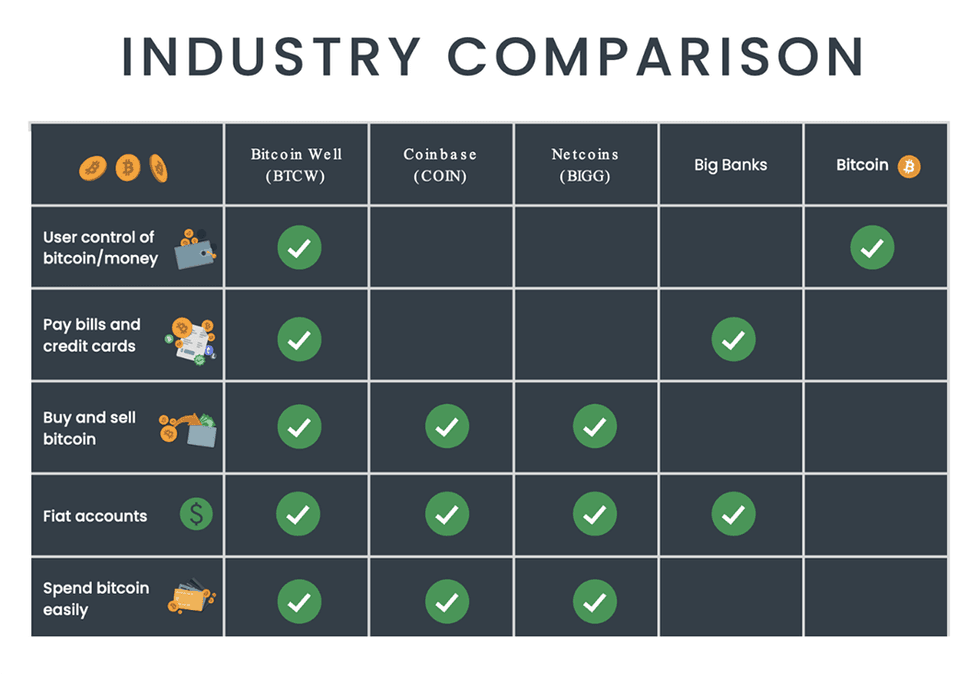

Bitcoin can be purchased through a variety of crypto exchange platforms and peer-to-peer crypto trading apps, and then held in a digital wallet. These include Coinbase Global, CoinSmart Financial (OTC Pink:CONMF,NEO:SMRT), BlockFi, Binance and Gemini.

What is Coinbase?

Coinbase Global is a secure online cryptocurrency exchange that makes it easy for investors to buy, sell, transfer and store cryptocurrencies such as Bitcoin.

How does crypto affect the banking industry?

Cryptocurrencies are an alternative to traditional banking, and tend to attract people interested in assets that are outside mainstream systems. According to data from Statista, 53 percent of crypto owners are between the ages of 18 and 34, showing that the industry is drawing younger generations who may be interested in decentralized digital options.

Privacy is a key draw for cryptocurrency owners, as is the fact that they are separated from third parties such as central banks. Additionally, crypto transactions, including purchases, sales and transfers, are often quick and have fewer associated fees than transactions going through the banking system in the typical manner.

That said, banks are starting to notice how popular cryptocurrencies are. As Bitcoin and its compatriots become increasingly mainstream, many banks have begun to invest in cryptocurrencies and blockchain companies themselves.

Will Bitcoin benefit from the banking crisis?

The banking crisis in the US and elsewhere has already led to a swift rush to Bitcoin from concerned investors. What started with the failure of Silicon Valley Bank on March 10, 2023, was followed by the collapse of Signature Bank two days later, leading to panic as investors and banking industry clients worried about what would come next. UBS' (NYSE:UBS) acquisition of its failing Switzerland-based rival Credit Suisse stoked concerns further.

While the banking crisis has seemingly receded into the background of economic news headlines, many analysts say it hasn't gone away and we can expect to see further fallout in the regional banking sector.

Bitcoin was established in the wake of the 2008 financial crisis as an alternative to the traditional banking industry, and in the past the price of Bitcoin has often shifted on narrative and sentiment. However, increasing regulations and its historic volatility make it hard to predict where the cryptocurrency could move next, especially as the crisis continues to unfold.

How much was Bitcoin when it started?

The first recorded Bitcoin transaction not involving the founder came in late 2009, when 5,050 Bitcoins were traded for US$5.02 over PayPal (NASDAQ:PYPL), pegging the value for 1 Bitcoin at about US$0.001 — a 10th of a cent.

Is Bitcoin a good investment anymore?

While Bitcoin has been climbing in value in 2024, one of its well-known features is its volatility. Investors who are more accepting of risk could look to the cryptocurrency space as there historically has been money to be made, and Bitcoin is regaining value after plummeting in 2022. However, there is also historically money to be lost, and investors who prefer to take smaller risks should look towards other avenues.

For more information on investing in Bitcoin right now, check out our article Is Now a Good Time to Buy Bitcoin?

What is Cathie Wood's prediction for Bitcoin?

Cathie Wood of ARK Invest is a strong proponent of Bitcoin, and has ambitious predictions for the coin's future. In a recent interview with CNBC following the SEC lawsuits against Binance and Coinbase, Wood said she has a base-case target of US$600,000 for Bitcoin by 2030, and a bull-case target of over US$1 million.

Who has the most invested in Bitcoin?

Satoshi Nakomoto, the mysterious founder of Bitcoin, is believed to also be the biggest holder of the coin. Analysis into early Bitcoin wallets has revealed that Nakamoto likely owns over 1 million of the nearly 19.5 million Bitcoins in existence.

Does Elon Musk own Bitcoin?

Tesla and Twitter CEO Elon Musk’s association with both Bitcoin and the meme coin Dogecoin is well known, and both his tweets and Tesla’s actions have influenced the cryptocurrencies’ trajectories over the years.

While it is unknown just how much he owns, Musk has disclosed that he personally has holdings of Bitcoin and Dogecoin, as well as Ether. It was revealed in September 2023 that Musk may be funding Dogecoin on the quiet, according to Forbes.

As for Tesla, as discussed above, the company purchased US$1.5 billion of Bitcoin in 2021, but sold 75 percent of that the next year. As of February 2024, the EV maker's Bitcoin holdings were estimated at 9,720 Bitcoin, the third-largest bitcoin holdings for a publicly traded company. In a January 2024 post on his social media platform X, Musk said “I still own a bunch of Dogecoin, and SpaceX owns a bunch of Bitcoin."

Does Warren Buffett own Bitcoin?

Warren Buffett does not own Bitcoin, and has expressed his dislike of cryptocurrencies in the past.

Buffett shared his disinterest in 2022 at an annual shareholders meeting for Berkshire Hathaway (NYSE:BRK.A,NYSE:BRK.B).

“If you told me you own all of the bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it?” he said. “I’d have to sell it back to you one way or another. It isn’t going to do anything.”

In an April 2023 interview with CNBC, when he said this of Bitcoin: “It’s a gambling token. It doesn’t have any value, but that doesn’t stop people from wanting to play a roulette wheel.”

This is an updated version of an article first published by the Investing News Network in 2021.

Don’t forget to follow us @INN_Technology for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.