Company Highlights

- Building a reliable vertically-integrated North American Critical Minerals project to produce cobalt chemicals for the rapidly expanding lithium-ion battery industry.

- One of the few advanced-stage cobalt projects outside of the Congo

- Average annual production of approximately 1800 tonnes of cobalt units in the first 14 years of the 20-year mine life

- Primary cobalt production independent of nickel and copper mining

- More than 1 million ounces of in-situ co-product gold

- 12 percent of global bismuth reserves

- Positive Feasibility Study

- Test mining and pilot plant validation of deposit and process methods

- Environmental Assessment approval for the mine, concentrator and access road in the Northwest Territories

- High concentration ratio of ores with simple flotation to capture the recoverable metals in a sulphide concentrate representing about 4% of the original mass of the ores for low cost transportation to the refinery and downstream processing

- Strong relationships with Indigenous and local communities and governments

- Federal, Northwest Territories and Tlicho Governments approval for the project and financial support for local infrastructure, including the $400 million Tlicho all-season highway project to Whati that recently opened to the public

- Value-added processing at the proposed refinery at a site to be finalized among a short list of brownfield sites

- Potential for additional business at the refinery from toll processing of concentrates from other mines and diversification into the metals recycling business

- Pursuing strategic partnerships and off-take with globally recognized firms

Overview

Fortune Minerals Limited (TSX:FT,OTCQB:FTMDF) is a Canadian mining company developing its wholly owned, vertically-integrated, NICO primary cobalt project in Canada to produce cobalt chemicals for the rapidly expanding lithium-ion battery industry. The NICO Mineral Reserves also contain 1.1 million ounces of gold, 12% of global bismuth reserves, and copper as a minor by-product. NICO is comprised of a planned mine and concentrator in the Northwest Territories and a related refinery in southern Canada where concentrates from the mine will be processed to energy– and eco-metals for the growing green economy. The cobalt, bismuth and copper contained in the NICO deposit are all classified as Critical Minerals, having essential use in new technologies, cannot be easily substituted with other minerals and their supply chains are threatened by geographic concentration of production in unreliable jurisdictions and/or countries with policy risks. NICO is expected to be a reliable North American producer of Critical Minerals with supply chain transparency and custody control of ethically-produced metals from ores through to the production of value-added metals and chemicals.

Fortune Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Overview

Fortune Minerals Limited (TSX:FT,OTCQB:FTMDF) is a Canadian mining company developing its wholly owned, vertically-integrated, NICO primary cobalt project in Canada to produce cobalt chemicals for the rapidly expanding lithium-ion battery industry. The NICO Mineral Reserves also contain 1.1 million ounces of gold, 12% of global bismuth reserves, and copper as a minor by-product. NICO is comprised of a planned mine and concentrator in the Northwest Territories and a related refinery in southern Canada where concentrates from the mine will be processed to energy– and eco-metals for the growing green economy. The cobalt, bismuth and copper contained in the NICO deposit are all classified as Critical Minerals, having essential use in new technologies, cannot be easily substituted with other minerals and their supply chains are threatened by geographic concentration of production in unreliable jurisdictions and/or countries with policy risks. NICO is expected to be a reliable North American producer of Critical Minerals with supply chain transparency and custody control of ethically-produced metals from ores through to the production of value-added metals and chemicals.

Company Highlights

- Building a reliable vertically-integrated North American Critical Minerals project to produce cobalt chemicals for the rapidly expanding lithium-ion battery industry.

- One of the few advanced-stage cobalt projects outside of the Congo

- Average annual production of approximately 1800 tonnes of cobalt units in the first 14 years of the 20-year mine life

- Primary cobalt production independent of nickel and copper mining

- More than 1 million ounces of in-situ co-product gold

- 12 percent of global bismuth reserves

- Positive Feasibility Study

- Test mining and pilot plant validation of deposit and process methods

- Environmental Assessment approval for the mine, concentrator and access road in the Northwest Territories

- High concentration ratio of ores with simple flotation to capture the recoverable metals in a sulphide concentrate representing about 4% of the original mass of the ores for low cost transportation to the refinery and downstream processing

- Strong relationships with Indigenous and local communities and governments

- Federal, Northwest Territories and Tlicho Governments approval for the project and financial support for local infrastructure, including the $400 million Tlicho all-season highway project to Whati that recently opened to the public

- Value-added processing at the proposed refinery at a site to be finalized among a short list of brownfield sites

- Potential for additional business at the refinery from toll processing of concentrates from other mines and diversification into the metals recycling business

- Pursuing strategic partnerships and off-take with globally recognized firms

Key Projects

The Cobalt Market

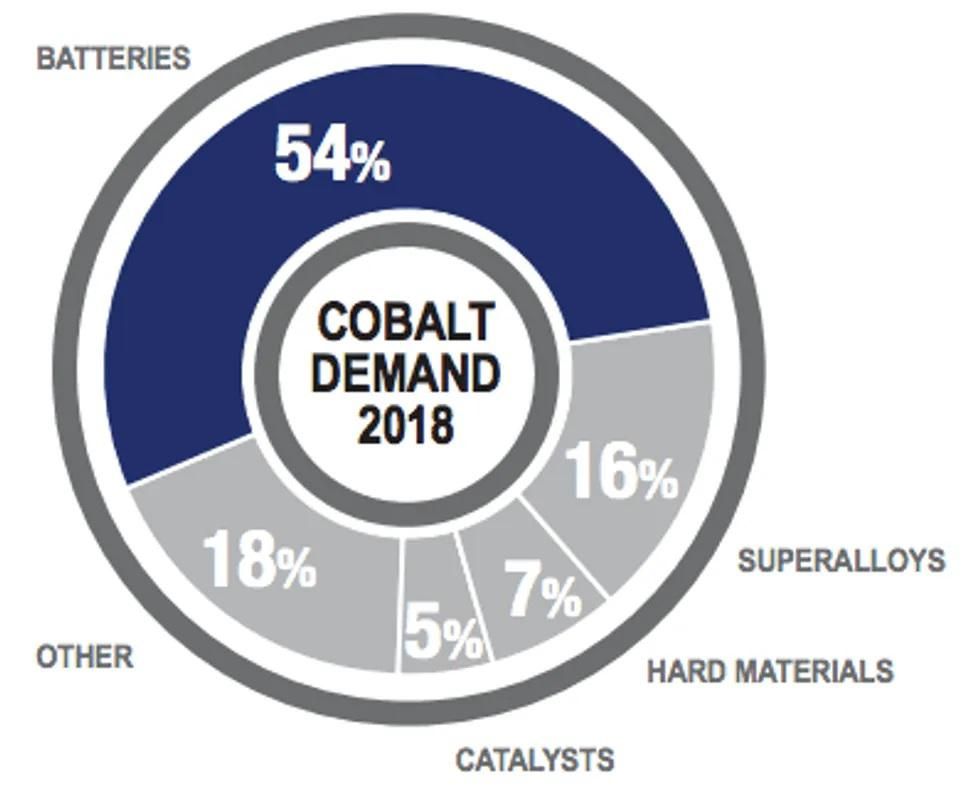

The cobalt market has been increasing for more than 20 years at an average six percent compounded annual growth rate (CAGR) and consumption is now approximately 150,000 tonnes of refined cobalt per year. The market is in a small supply deficit that is expected to increase beyond 2023 with increasing demand in rechargeable batteries exceeding the production in the Democratic Republic of Congo (DRC), other global producers and identified development projects.

Battery use is primarily to make the cathodes of lithium-ion batteries, used in portable electronic devices, electric vehicle (EVs) and stationary storage cells to make electricity use more efficient. Batteries are now responsible for more than 64 percent of global cobalt demand, up from one percent of a smaller 35,000 to 40,000 tonne market in the mid-1990s. Cobalt is also used in superalloys for the aerospace industry, cemented carbides, cutting tools, permanent magnets, surgical implants, catalysts, pigments and agricultural products. The 20-year inflation adjusted price of cobalt is approximately US$25 per pound.

Demand for cobalt is expected to accelerate from increasing adoption of EVs and energy stationary storage cells. Since 2014, more than 225 battery megafactories (production greater than 1 gigawatt-hour (GWh) have been completed, are under construction or announced to produce more than 4,100 GWh of energy storage. EV adoption is expected to push consumption of cobalt to approximately 400,000 tonnes per year by 2030 according to Benchmark Mineral Intelligence and other analysts, an increase of between two and three hundred percent of current production levels. Many countries have announced future bans on cars with internal combustion engines and/or stricter emission standards helping drive the transformation to electric mobility and cost parity.

Cobalt is generally considered to be the bottleneck in the supply chain for the increased demand for lithium-ion batteries. This is attributed to the lack of alignment between the minerals industry's ability to develop new mines and the more rapid advancement of new technologies needing and their associated raw materials. It is also exacerbating geographic concentration of production in the DRC, which is responsible for about 70 percent of current mine production more than half of which is controlled by Chinese state-owned companies. China is also the dominant producer of refined cobalt (60 percent) and it also produces in excess of 80 percent of refined cobalt chemical supply, resulting in policy risks to western battery and automotive manufacturers. About 98 percent of non-artisanal cobalt production is also produced as a by-product of nickel or copper mining where the primary metals determine production criteria. Responsible sourcing has become an issue with some DRC production due to child labour, and concerns over conflict minerals, poor environmental and social governance (ESG) practices and the lack of supply chain transparency. There is increasing pressure from the Responsible Business Alliance (RBA), an organization of major electronics companies, to adhere to better ESG principles in their battery supply chains that could otherwise damage their brands.

The NICO project is a planned reliable Canadian vertically-integrated producer of cobalt sulphate to mitigate supply chain issues around cobalt, which is identified as a Critical Mineral by countries including Canada, U.S., E.U., U.K, Japan and Korea.

NICO Co-Products

NICO is a primary cobalt deposit, but the Mineral Reserves also contain 1.1 million ounces of gold as a countercyclical and highly liquid co-product that can be easily converted to cash. The gold contained in the NICO deposit stands out among other cobalt projects where the metal is produced primarily as a by-product of copper and/or nickel.

NICO is also the largest known deposit of bismuth in the world with about 12% of global reserves – even though it represents only about 15% of projected revenues from operations at current metal prices. Bismuth is a metal with unique physical properties, including high density, very low melting temperature, non-toxicity and it is one of the few elements that expands when cooled. The market is approximately 20,000 tonnes per year, but demand is growing, primarily as a non-toxic replacement for lead. China currently controls about 75% of world production and reserves.

Bismuth is used primarily in the automotive industry for glass frits, anti-corrosion alloys, and metallic paint lusters and pigments. It also has anti-bacterial properties and is the primary ingredient in medicines such a Pepto-Bismol ®. The low melting temperature of bismuth is used in the trigger mechanism for fire protection sprinkler systems. Bismuth is scientifically recognized as environmentally safe and non-toxic, and otherwise has physical properties similar to lead. Bismuth consumption is therefore growing as a lead replacement metal in plumbing and electronic solders, brass particularly for potable drinking water valves and fixtures, free machining steel and aluminum, hot-dip and electroplated galvanizing alloys, ceramic glazes, paints, glass, radiation shielding, cosmetics ammunition and fishing weights.

Fortune expects to have average annual bismuth production of 1,700 tonnes during the first 14 years of the 21-year mine life. This represents approximately 8.5% of the annual market, however, two major bismuth producers are no longer in the business and annual consumption is increasing providing for an attractive market for a new Canadian vertically integrated supplier.

NICO Project

Excellent infrastructure in place and under development

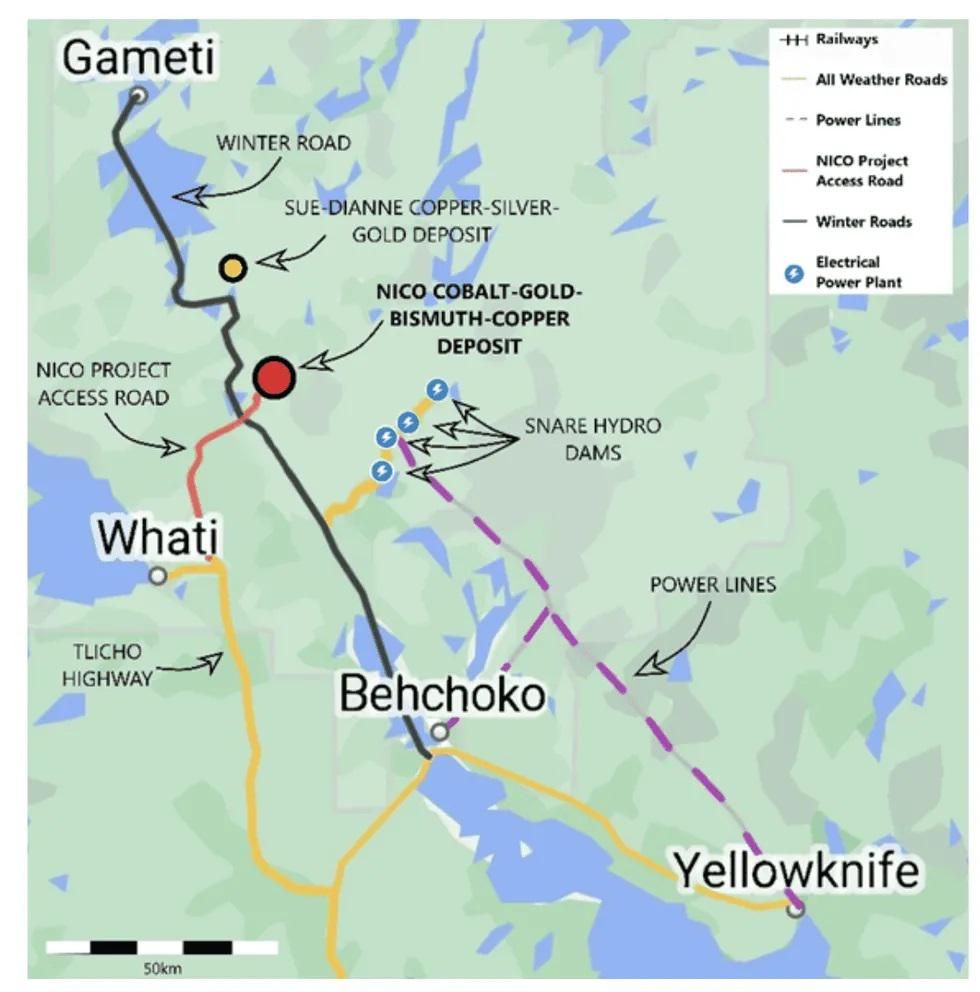

The NICO cobalt-gold-bismuth-copper deposit is an IOCG or Olympic Dam-type mineral deposit situated on 5,140 hectares of mining leases, located 160 kilometers northwest of the City of Yellowknife and 50 km north of Whati in Canada's Northwest Territories. There is all-season road access to Whati via Highway 9, a $400 million design/build/operate/maintain private-public partnership between the Government of the Northwest Territories and North Star Infrastructure. Up to $53 million of the capital costs for the project were contributed by the federal government through the Canadian Infrastructure fund. Fortune Minerals has received Environmental Assessment approval to build a 50-kilometre spur road from Whati to the mine site and is included in the mine site capital costs. With construction of the spur road Fortune will be able to truck metal concentrates from the mine to the railway at Enterprise or Hay River and delivery them by rail to the Company's planned refinery in southern Canada. The NICO leases are located 25 kilometers west of the Snare hydro complex and electrical grid servicing Yellowknife.

Large, well-defined polymetallic deposit

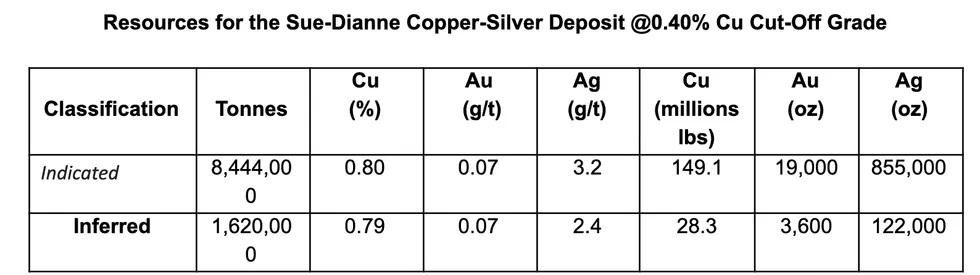

NICO and the Company's satellite Sue-Dianne Copper-Silver-Gold deposit are classified as Iron Oxide-Copper-Gold (IOCG)-type deposits with world class global analogues including Olympic Dam in South Australia, the Salobo and Sossego deposits in Brazil, and the Candelaria district deposits in Chile. They occur in clusters of multiple deposits, commonly aggregating more than a billion tonnes in similar tectonic and geological environments.

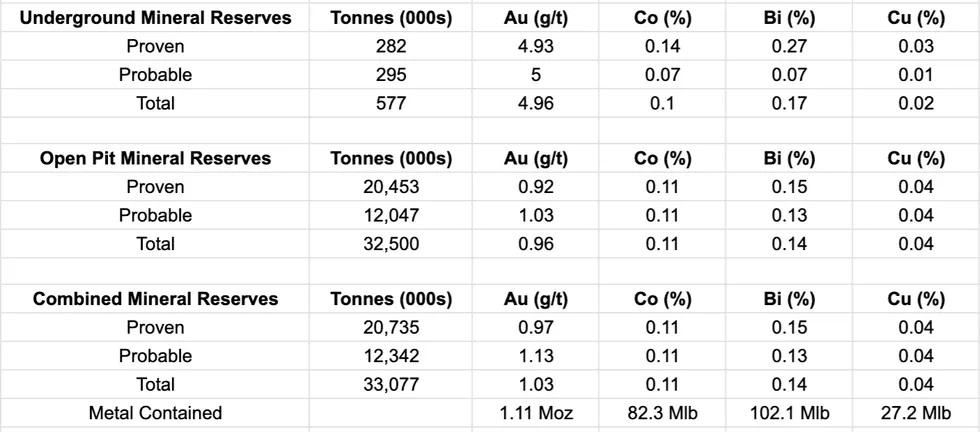

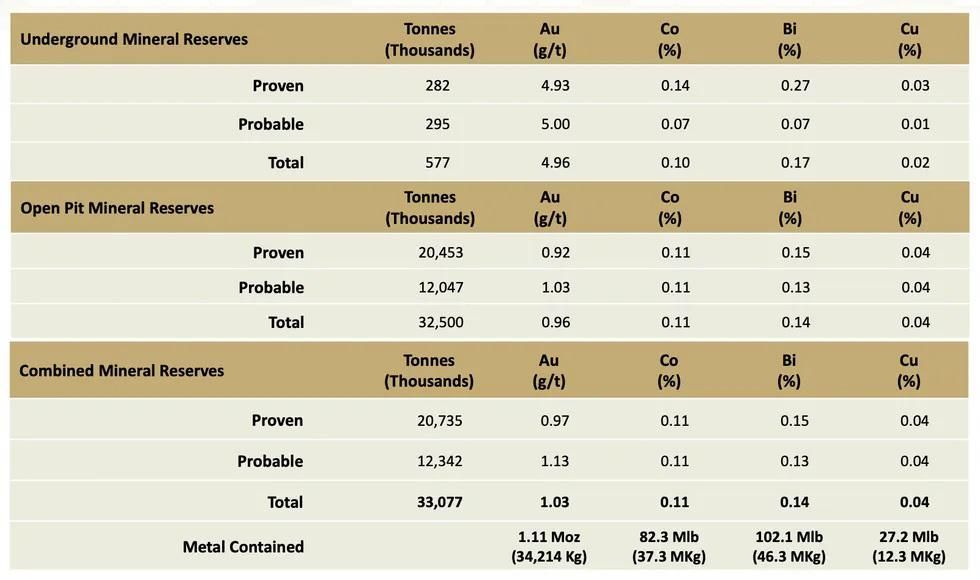

The Mineral Reserves for the NICO Deposit were estimated in Compliance with NI-43-101 and total 33.1 million tonnes, containing 82.3 million pounds (37,341 tonnes) of cobalt, 1.1 million ounces of gold, 102.1 million pounds (46,325 tonnes) of bismuth and 27.2 million pounds (12,296 tonnes) of copper to support a 20-year mine life at a mill throughput rate of 4,650 tonnes of ore per day. The Mineral Reserves are based on 327 drill holes plus surface trenches and underground test mining verifying the deposit grades, geometry and mining conditions. Both of Fortune's deposits are open for potential expansion and there is significant potential to extend the deposits with additional drilling or identify new zones or deposits. Two large combined gravity, magnetic and magnetotelluric anomalies were identified on the Company's leases that are being drill tested in late 2021.

Nico Mineral Reserves

NICO Project De-Risking

Fortune Minerals has expended in excess of $135 million preparing technical, environmental and social studies to support the development of the NICO cobalt-gold-bismuth-copper project. Environmental Assessment approval and the major mine permits have been received for the planned facilities in the Northwest Territories.

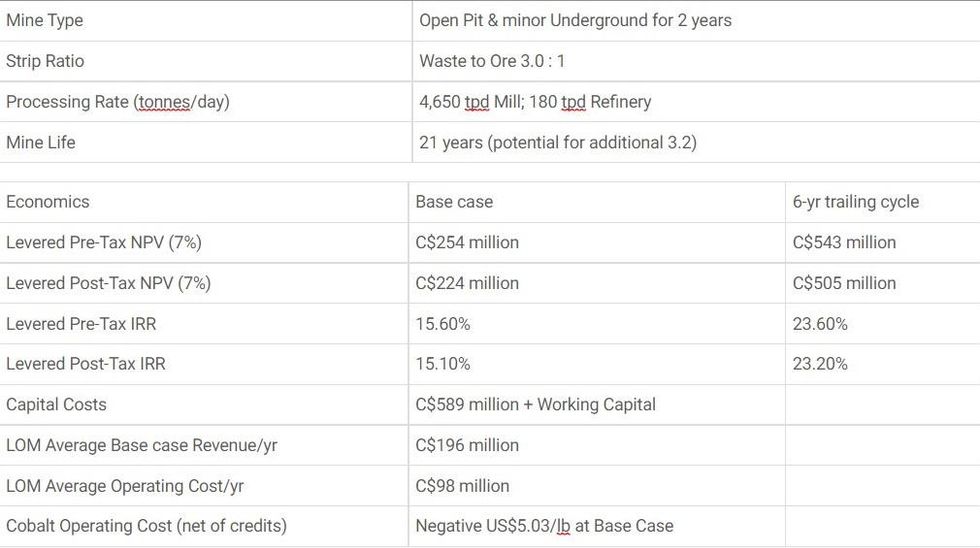

A positive Feasibility Study was completed in 2014 by Micon International Limited (Micon) that identified the Mineral Reserves to support a 20-year mine life at a mill throughput rate of 4,650 tonnes of ore per day. The Feasibility Study and previous Front End Engineering and Design Study by Aker Solutions contemplated combined open pit and underground mining during the first two years of the mine life, followed by only open pit mining. The sulphide concentrates produced at the mine would have been transported to a planned refinery near Saskatoon for hydrometallurgical processing to produce cobalt sulphate, gold doré, bismuth ingots and oxide and a copper precipitate.

Fortune completed underground test mining to verify the NICO deposit grades, geometry, and mining conditions and to collect large samples of fresh ores for pilot plant testing, validating the process flow sheet, metal recoveries and to produce samples of cobalt sulphate for testing by potential customers

Environmental Assessments were completed for the mine and refinery, and the mine site facilities have received the major mine permits. Fortune has completed an Access Agreement with the Tlicho Indigenous Government setting out the conditions for the mine access road that would be built on Tlicho lands. A Socio-Economic Agreement has also been completed with the Northwest Territories Government.

The Company has assessed numerous optimizations to produce a more financially robust project and is assessing a number of alternative refinery sites with Industrial Zoning that are also brownfield with existing facilities and closer to the NICO mine. The Feasibility Study would then be updated based on the recent work. Fortune is also working to arrange the project financing for the construction of the NICO project through a combination of strategic partnerships, debt and equity and has executed Confidentiality Agreements with a number of financial institutions and potential strategic partners.

2014 Micon NICO Feasibility study

Micon was retained to prepare a Feasibility Study in 2014 based on the 2012 Front-End Engineering and Design Study by Aker Solutions and a proposed project financing joint venture that was proposed under a Memorandum of Understanding (MOU) with Procon Group (Procon) and China CAMC Engineering Co., Ltd. (CAMCE). Procon was the underground mining contractor for the previous test mining and bulk sampling project. The transaction had proceeded to bank due-diligence, but was not completed due to a change in the business strategy for CAMCE following the change in leadership in China at that time.

The Feasibility Study was based primarily on open pit mining methods, but augmented with ores mined by underground methods during the first two years of the 20-year mine life. The underground ores allow for earlier processing of gold-rich, high grade ores sourced near the existing underground ramp system to accelerate cash flows.

Ores would be processed in a mill and concentrator at the NICO site at a throughput rate of 4,650 tonnes per day. A key economic attribute of the NICO process methodology 0is a very high concentration ratio (low mass pull) that captures the recoverable metals in only 4% of the mass of the ore. Only 180 tonnes of bulk concentrate would be produced per day containing the recoverable metals for low cost trucking to the rail head ay Hay River and delivery by rail to the planned refinery, which was near Saskatoon in the Micon study.

The NICO project refinery location in southern Canada would leverage lower cost power, lower capital and operating costs, proximity to reagents and proximity to a local skilled pool of chemical plant workers and engineers. The southern location would also enable the refinery to treat metal concentrates from other projects and from recycling of chemical plant residues, scrap metals and spent batteries.

The NICO refinery previously included a secondary flotation circuit to process the bulk concentrate into separate cobalt and bismuth concentrates – both containg gold. This circuit was subsequently moved to the mine site to provide more sales optionality. At the refinery, cobalt concentrate would be treated by high pressure acid leach (HPAL) in an autoclave to dissolve the contained cobalt and copper, which would then be precipitated by sequential neutralization. The cobalt circuit contemplated solvent extraction purification and crystallization to a high-purity cobalt sulphate heptahydrate crystals. Copper would be cemented onto iron and sold as a metal precipitate. The bismuth circuit contemplated leaching in ferric chloride, followed by electro-winning to an impure cathode, and then smelting in a small rotary furnace to pour metal ingots or calcined to an oxide product. The residue from the bismuth circuit containing most of the gold would be blended with the cobalt concentrate (also containing gold) prior to autoclave processing to mitigate refractory losses. The autoclave combined leach residue would then be processed in a small cyanide circuit followed by Merrill-Crowe precipitation and smelting to doré bars.

Fortune Minerals believes there are also future revenue-generating opportunities at the refinery with custom processing of materials sourced from other mines as well as diversification into the battery and metals recycling business.

Feasibility Study Highlights

Highlights from the 2014 feasibility study are as follows:

2014 Feasibility Mineral Reserves

Sums of the combined reserves may not exactly equal sums of the underground and open pit reserves due to rounding error

Metal recoveries from ores to final products

- Gold Recovery Ranges from 56 to 85 percent, with an average ~73.7 percent

- Cobalt Recovery ~84 percent

- Bismuth Recovery ~72 percent

- Copper Recovery ~41 percent

*The 2014 feasibility study reflected in the Micon Technical Report uses base case price assumptions are US$1,350 per troy ounce for gold, US$16 per pound for cobalt (US$19.04 per pound in sulphate), US$10.50 per pound for bismuth (US$12.64 per pound bismuth in average production of ingot, needles and oxide) and US$2.38 per pound for copper at an exchange rate of C$1=US$0.88; Cycle price sensitivity analysis uses US$1,200 to US$1,900 per ounce gold, US$ 12-30 per pound cobalt, US$7 to US$19 per pound bismuth and US$3 to US $4.50 per pound copper

Fortune Minerals has been assessing various optimizations it has recognized to make a more financially robust project. They include:

- Preparation of a new Mineral Resource block model with a more constrained approach to the mineralization interpolation boundaries to reduce internal and external dilution and better differentiate higher grade resource blocks for early processing

- The block model also identified some high grades that were missing in previous Mineral Resource estimates as well as mineralized material at the volcanic sedimentary rock interface that was not previously included

- The grade interpolation wireframe boundaries were also extended to surface where the deposit is known to outcrop and to depth where the gold zone had been too abruptly terminated

- A new mine plan and production schedule was completed from the new Mineral Resource model with a re-optimized open pit shell and more selective underground mining of gold-rich ores located close to the existing decline ramp during the first three years of the mine life (previously first two years)

- The open pit mine fleet was optimized with smaller equipment to reduce dilution with waste rock and match the lower mining rate

- A grade grade control & stockpiling strategy to defer processing of lower margin ores

- Alignment of the construction schedule with availability of Tlicho Highway to reduce capital costs & supply chain risks

- Identification of brownfield refinery locations with existing municipal approvals and facilities to reduce capitals costs for the refinery

- Deferred capital expenditures to lower initial capital

- Assessing opportunities for higher gold recoveries at mine site

- Commodity prices for all metals were updated

- Assessing opportunities for Federal & provincial government support for project the project based on Critical Mineral policy objectives

Mineral resources that are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. The quantity and grade of reported inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category.

Fortune Key Takeaways

- IOCG deposits with existing Mineral Resources and Mineral Reserves

- Deposit-scale and blue-sky exploration potential

- Development stage NICO asset

- Reliable supply of cobalt and bismuth from a Canadian vertically integrated mining/refining project with supply chain transparency mitigating geopolitical risks with the current supply sources

- Primary cobalt supply with average annual production of 1800 metric tonnes of cobalt units per year contained in a cobalt sulphate heptahydrate product

- Largest deposit of environmentally friendly bismuth (12% of global reserves) with average annual production of 1700 metric tonnes contained in metal ingots and oxide products

- Highly liquid and countercyclical gold co-product

- Copper as a minor by-product

- C$135 million invested to date in 25-years of comprehensive validation work to produce an essentially shovel-ready project for development

- Environmental Assessment approval and major mine permits in hand from federal, Territorial and Indigenous governments and regulators

- Agreements with Tlicho Indigenous Government and a Socio-Economic Agreement with the Northwest Territories government

- Government financial support for the project, including an indirect C$400 million investment in a new all-season road, planned hydro investments, and indicative interest in supporting an updated Feasibility Study and project finance

- Hydrometallurgical refinery sites under investigation with geographic synergies and existing facilities to reduce capital and operating costs for the project

- NICO concentrates provide base load for the planned refinery, but production is expected to be increased from custom processing of concentrates from other projects and by processing waste residues from chemical plants, scrap metal recycling, and recycling of spent batteries

- Future vertically integrated Critical Minerals supplier for geographic raw material soucing silos for the North American lithium-ion battery industry

- Near-term potential supplier of cobalt to help reduce the expected supply deficit in a timeframe that aligns with the current demand for batteries

- Management team with proven northern exploration, permitting, development and operations experience

- Seeking a strategic financial partner to help develop the project tied to off-take and project validation

Management Team

Mahendra Naik, B.Comm., CPA, CA – Chairman and Director

Mahendra Naik is a Chartered Accountant and a founding director and a key executives in starting IAMGOLD Corporation, a TSX and NYSE-listed gold mining company. As Chief Financial Officer from 1990 to 1999, he was involved in the negotiations of the Sadiola and Yatela mine joint ventures with Anglo American and US$400 million in project debt financings for the development of the mines. He was also involved with more than $150 million in equity financings, including the Initial Public Offering. Mahendra is currently Chief Executive Officer of FinSec Services Inc., a private business advisory company and a director of FirstGlobalData Limited, Goldmoney Network Limited and Jameson Bank.

Robin E. Goad, M.Sc., P.Geo. – President, CEO and Director

Robin Goad is a professional geologist with more than 40 years of experience in the mining and exploration industries in Canada and internationally, including particular expertise in working in Canada's far north. Mr. Goad led the team responsible for discovery of the NICO deposit and managed the work programs transitioning the project to the development phase. Prior to founding Fortune in 1988, Goad worked for large companies including Noranda and Teck, and as a consultant to the resource industry. He is a director of the NWT & Nunavut Chamber of Mines and has served as President and director of other TSX listed mineral exploration and development companies.

Glen Koropchuk, B.Sc., M.Sc., Calgary, Alberta – Technical Director

Glen is a mining engineer with approximately 30 years of global, multiple commodity, operations, project development and corporate social investment experience predominantly with Anglo American & De Beers. Prior to his retirement from De Beers Canada in 2016, Mr. Koropchuk was COO and responsible for delivering safe, operational excellence from the Snap Lake and Victor diamond mines in Canada's north. Notably, he also led the permitting, Aboriginal engagement, and project management for the Gahcho Kue diamond mine in the Northwest Territories that was finished on budget, on time, and was recognized as the world's largest new diamond mine at its opening ceremony in 2016.

John McVey , M.A.Sc., P.Eng, ICD.D – Director

John is the CEO and an Executive Director of the Procon Group of Companies. His engineering and construction industry career spans more than 35 years in the mining, energy and power industries in Canada and internationally. John joined Procon as CEO in 2015 and is leading the growth and diversification of this full-service mine development and civil infrastructure contractor across Canada and in select other countries. Prior to Procon, John held executive and senior management positions with Bechtel, SNC-Lavalin and Kilborn Engineering. John McVey has B.A.Sc. and M.A.Sc. degrees in Chemical Engineering from the University of Waterloo and is a licensed Professional Engineer in Ontario and Alberta. He has completed the Queen's Executive Development Program and the Institute of Corporate Directors, Directors Education Program, obtaining the ICD.D designation from the Institute.

Edward Yurkowski B,Sc. – Director

Ed Yurkowski served as CEO of Procon, a provider of mining services through Procon Mining & Tunneling Ltd before retiring from that position in 2014. Ed Yurkowski has been involved in the mining and civil contracting industries since 1966, including ownership and management of two large mining construction contracting companies. He received his Bachelor of Science in Civil Engineering in 1971 from the University of Saskatchewan and currently serves as a director of other TSX and TSX Venture Exchange listed companies, including Imperial Metals Corp., Golden Band Resources Inc., BC Moly Ltd. and Copper Lake Resources Ltd.

David Ramsay, B.A. – Director

David Ramsay is a consultant with extensive elected public office experience in the Northwest Territories, including prominent cabinet positions in the Legislative Assembly. He has been the Minister for Industry, Tourism and Investment, Justice, Transportation, Public Utilities Board and Attorney General. David was also previously President of the Pacific Northwest Economic Region (PNWER), a public / private partnership of western Canadian provinces and territories and northwestern U.S. states with a mandate to increase the economic well-being and quality of life for all citizens of the region. As a long-term resident of the Northwest Territories, David has been involved with numerous businesses. He was first elected to public office in 1997 and served five years as a Yellowknife City Councilor before his election to the Legislative Assembly.

Patricia Penney, B.Comm (Hon. Accounting), CPA, CA – Interim CFO

Patricia Penney is a Chartered Accountant with 20 years of accounting and audit experience. Prior to Fortune, she was a Senior Manager with Caceis Canada Ltd., an alternative fund administrator.

David A. Knight, B.A., LL.B. – Corporate Secretary

David is a partner with Weir Foulds LLP, a Canadian legal practice with extensive expertise in the resource sector. David specializes in securities law, including public and private financings, mergers and acquisitions, stock exchange listings and regulatory compliance and acts for investment dealers and issuers. David is a member of the Law Society of Upper Canada.

Richard Schryer, Ph.D. – Vice President of Regulatory and Environmental Affairs

Rick Schryer is an aquatic scientist with more than 25 years of experience in mine permitting, environmental assessments, environmental studies and monitoring. Prior to Fortune, he worked with Golder Associates and was involved with the permitting and environmental assessments for the Diavik and Snap Lake diamond mines in the Northwest Territories as well as projects in southern Canada

Troy D. Nazarawicz, CIM, CPIR – Investor Relations Manager

Troy Nazarewicz has 17 years of experience as an investment advisor and portfolio manager with MacDougall, MacDougall & MacTier Inc. He also worked as a Business Development Manager with a design and marketing firm.

Dustin Reinders, B.Sc., P.Eng. – NICO Project Engineer

Dustin Reinders is a mining engineer with more than 10 years of experience in the mining industry and earthworks construction performing engineering and management roles. He has previously worked for Northgate Minerals at the Kemess South mine and with North American Construction Group at various mine sites in Fort McMurray. Dustin is a graduate of the University of Alberta with a Bachelor of Science degree in Mining Engineering.

Sherry Tunks – Supply Chain Manager

Sherry Tunks has 15 years of supply chain experience within the mining, automotive supply and manufacturing industries and is responsible for purchasing and supply chain management for the company.

*Disclaimer: This profile is sponsored by Fortune Minerals ( TSX:FT ). This profile provides information which was sourced by the Investing News Network (INN) and approved by Fortune Minerals in order to help investors learn more about the company. Fortune Minerals is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Fortune Minerals and seek advice from a qualified investment advisor.

Fortune Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.