Company Highlights

- Electric Royalties is a royalty company established to take advantage of the demand for a wide range of metal commodities, which benefit from the drive toward electrification of a variety of consumer products and industries like transportation, battery development and energy.

- The company is generating revenue from a growing portfolio of 19 royalties focusing predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio in politically stable jurisdictions.

- Market research expects electric vehicle sales, battery production and renewable energy generation to increase significantly over the next several years. Demand for valuable commodities necessary for the production of electric vehicles is slated to grow with these trends.

- Electric Royalties leverages a unique opportunity to invest in and acquire royalties over highly prospective mines and projects that host widespread mineralization of commodities like zinc, lithium, copper, nickel, tin, manganese, vanadium, graphite and cobalt.

- The company’s management team brings together an experienced team with decades of expertise in finance, mining, business development and more.

- Electric Royalties closed the acquisition of a 0.5 percent gross revenue royalty on the Zonia Copper Oxide Project in Arizona, USA with World Copper Ltd. (TSX.V:WCU)(OTCQB:WCUFF)(FRA:7LY0).

Overview

The increasing popularity of electric vehicles and the green energy movement has disrupted the transportation and power industry entirely. By 2050, over 17 countries announced 100 percent zero-emission vehicle targets or goals to phase out internal combustion engine vehicles.

Seeing these unprecedented trends in growth across the electric vehicle market means the demand for key raw materials used in the lithium-ion batteries needed to power these technological innovations could experience significant parallel growth. As prices for these raw commodities grow, market researchers predict more money investment opportunities coming into the sector. Especially for royalty companies with widespread exposure across the market, the investment upside could be significantly advantageous.

Electric Royalties Ltd. (TSXV:

ELEC; OTCQB:ELECF) is a royalty company focused on building a

premium portfolio that takes advantage of the demand for a wide range of commodities and critical metals like lithium, vanadium, manganese, tin, graphite, zinc, cobalt, nickel and copper. Focusing on these vital elements leverages the growing demand and global drive toward electrification across virtually all sectors, including transportation, rechargeable batteries, large-scale energy storage, renewable energy generation and more.

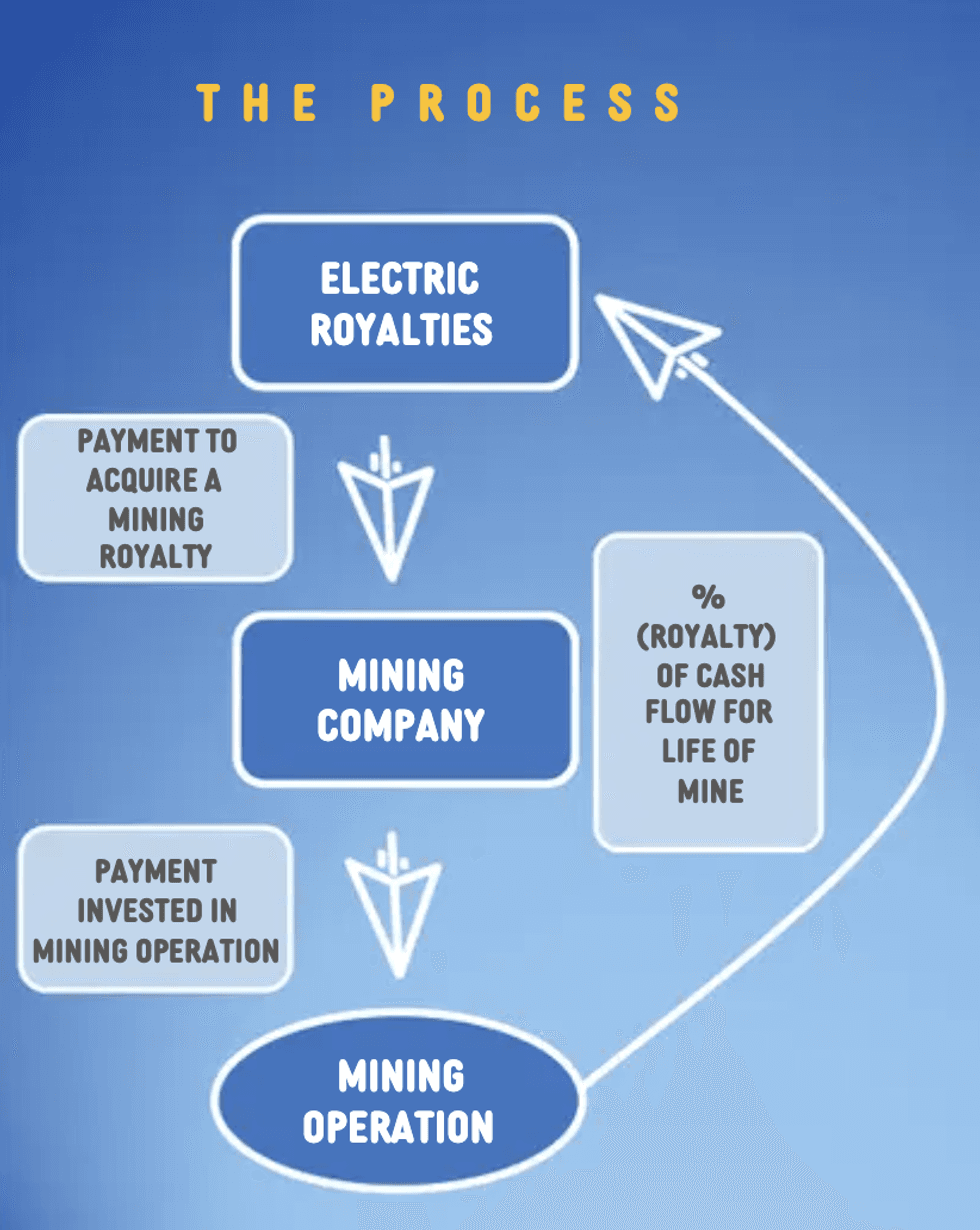

As a royalty company, Electric Royalties does not operate mines nor needs large and highly specialized teams to carry out their operations. Likewise, having a robust commodity portfolio helps to diversify investment and mitigate risk for investors and shareholders while leveraging exploration upside, revenue-driven business modelling and more. It currently has a growing portfolio of 19 royalties on assets located primarily in North America and Australia.

The company operates

a two-tier approach to royalty acquisition. It has a strategic global focus for projects in politically stable jurisdictions with an emphasis on districts with strong legal and mining frameworks. Additionally, Electric Royalties focuses on lifelong assets with outstanding exploration potential, which leverage near-term production potential, advanced staging, multiple commodity cycles, resource upgrades and producing opportunities.

Unlike other royalty companies, Electric Royalties has an exceptionally robust nine commodity portfolio and a top management team that understands the ins and outs of how the royalty game works. “We’re creating new royalties where we make sure it’s gross revenue, covers the whole deposit and it’s drafted by us. At this point in time, we do this for a living. Ultimately, you’re going in, and you’re creating and adding some value to a group,” commented Electric Royalties CEO and director Brendan Yurik.

In May 2022, Electric Royalties closed a CAD$3.45 million marketed public offering with Cannacord Genuity Corp. (TSX:CF) as the lead agent and sole bookrunner. The offering was composed of 11,500,000 units at CAD$0.30 per unit. Net proceeds of the offering will fund potential future acquisitions of royalties and other interests.

Electric Royalties’ management team is an experienced group of executives and advisors with proven track records of success across multiple related industries like mining, finance and more. Together, their years of expertise primes the company for significant growth in line with the exponential growth forecast in the demand for clean energy metals globally.

Key Royalties

Middle Tennessee Zinc Mine Royalty

This producing zinc asset hosts levels of annual production hovering 50,000 tons of zinc concentrate across a 15-year mine life.

Middle Tennessee zinc mines have produced over 2.7 billion pounds of zinc for over 50 years. The strategically positioned zinc mine leverages close proximity and association with Trafigura’s Clarksville smelter, the only primary zinc producer in the US.

In April 2022, Electric Royalties announced that the strong upward trend in the zinc price has significantly increased the Middle Tennessee Mine zinc royalty payments. The MTM zinc royalty is in a limited partnership with Electric Royalties owning a 25 percent of economic interest with the remaining 75 percent interest held by Sprott Streaming and Royalties Corp. From the time the MTM zinc royalty was acquired to March 31, 2022, the aggregate gross amount of royalty revenue accrued to MTM LP on a 100 percent basis is approximately US$1,158,000 and a total of US$289,000 is attributable to the company.

Authier Lithium Royalty

The Authier Lithium is a 0.5 percent gross revenue royalty and the project sits in close proximity to the only producing lithium mine in Canada about 45 kilometers northwest of Val d’Or and is operated by Sayona Lithium. It stands as a simple, near-surface deposit with resources defined in one spodumene-bearing pegmatite based on 31,000 metres of diamond drilling. Authier also leverages excellent infrastructure, including existing mining support services, environmentally-friendly low-cost hydroelectric power, gas and road networks.

On May 23, 2022, Sayona Mining Limited (ASX:SYA) announced a pre-feasibility study for its flagship North American Lithium Project in Québec, Canada which also integrated the Authier Lithium Project with the NAL operation into Sayona’s Abitibi

Lithium Hub. Sayona Mining plans to release an updated feasibility study for the Authier Project in Q2 2022.

Graphmada Graphite Royalty

The near-production Graphmada Large Flake Graphite Mining Complex is located in Eastern Madagascar and was in continuous production for 30 months prior to being placed in care and maintenance due to Covid-related restrictions put in place at the start of 2020. The operator Bass Metals has been using the down time to look at an expanded production case set to be released in the near future and recently increased its mineral resource by 41 percent to 20.2 million tonnes (Mt) of >90 percent large flake graphite. All mining and processing infrastructure, including roads, bridges, power, camp, tailings dams are in place, along with 40-year mining permits and 20-year landholder agreements. The complex sits adjacent to the main national highway and is110km to the country’s only deep-water port at Toamasina. The royalty is a 2.5 percent gross revenue royalty.

Greenwing Resources (ASX:GW1) completed its 3,268-metre drill program in Madagascar comprising 69 diamond holes, with results recording significant intercepts of graphite mineralization. The drill program has significantly expanded the mineralization footprint of the Graphmada Mineral Resource. Greenwing also plans to assess the need for further drilling to update resource confidence and test the mineralization laterally.

Bissett Creek Graphite Royalty

BISSETT CREEK IN PROXIMITY TO EV BATTERY MEGAFACTORIES (BY 2050). Source: Northern Graphite.

The Bissett Creek property sits between Ottawa and North Bay in Ontario, Canada. The feasibility stage asset has a potential annual production level of 33,200 tons with a mine life of approximately 21 years at a US$1,800 revenue per ton ratio.

Bissett Creek hosts open pit mining potential and has already seen significant bulk sampling, pilot plant testing and recoveries of over 92.4 percent graphite. The next steps include further exploration and production expansion of some of the highest large flake yields reported from any graphite project globally.

Mont Sorcier Vanadium Royalty

The Mont Sorcier property hosts a large-high-quality iron resource with significant and extractable vanadium in a top-tier mining jurisdiction.

Exceptionally low titanium content makes the deposit unique to other iron-titanium-vanadium deposits around the world. Low titanium in the deposit allows the iron ore and vanadium processing directly through a blast furnace for potential lower-cost operations and open-pit mining with a life of mine strip ratio of 0.89.

Glencore has entered into a long-term arrangement to support the development of the Mont Sorcier project and is assisting with raising capital to finalize feasibility studies.

Battery Hill Manganese Royalty

Battery Hill is a historic resource that spans 1,228 hectares and leverages fast-tracked feasibility study stage potential. Kemetco currently has operations to develop and commercialize a flow sheet to produce a battery-grade manganese product for the growing electric vehicle and energy storage industries. The property leverages great highway access and transmission lines. Electric Royalties has early-mover potential with Battery Hill as there are no producing manganese mines in North America.

Royalty asset partner Manganese X Energy (TSXV:MN) published a preliminary economy assessment (PEA) showing significant gross revenue projections for the Battery Hill project of US$177 million per year over an initial forecast mine life of 47 years. Electric Royalties' 2% gross revenue royalty entitles the company to 2% of those gross revenues. The Battery Hill PEA forecasts robust economics and a short payback period for relatively low capital investment.

In early 2022, Manganese X Energy initiated discussions with potential strategic partners seeking high-purity manganese products and started the development of the pilot plant program for the Battery Hill manganese project. Manganese X intends to engage an engineering firm to design the work for its field pilot plant to demonstrate Manganese X’s proprietary process under near commercial-scale operating conditions incorporating a modular design. The pilot plant will use innovative solutions to produce high-purity manganese sulphate without the use of selenium.

For more information on Electric Royalties’ complete royalty portfolio, see its corporate presentation here https://www.electricroyalties.com/presentation

Management & Board of Directors

Brendan Yurik - CEO & Director

Brendan Yurik is the founder and CEO of Evenor Investments Ltd, a financial advisory group to junior mining companies for alternative financing, debt, equity and M&A with experience on over CAD$2 billion in mining financing transactions throughout his career. He has prior global experience as a research analyst as well as in business development and mining financial advisory roles with Endeavour Financial, Cambrian Mining Finance Ltd, Northern Vertex Mining Corp. and King & Bay West Management Corp.

Luqman Khan - CPA, CGA, CFO

Luqman Khan is also the CFO of RE Royalties Ltd, a renewable energy royalty company, involved in the acquisition of 86 royalties to date. He has been a financial reporting executive with over 20 years of professional experience in accountancy and business management. Additionally, Khan has served as CFO for several publicly listed TSX-V resource companies and previously with Ernst and Young in their assurance practice.

David Gaunt P.GEO - Chief Geo-Scientist

David is an economic geologist specializing in project assessment and resource estimation. His experience spans projects worldwide and includes roles with senior mining companies and junior exploration companies. He is a co-recipient of the PDAC’s Thayer Lindsley International Discovery Award.

Marchand Snyman CA - Chairman and Director

Co-founder and Chairman of RE Royalties Ltd, a renewable energy royalty company, involved in the acquisition of 84 royalties to date. Over 25 years senior executive experience in corporate finance and mining with a global merger, financing, acquisition and divestiture track record of more than 50 transactions.

Craig Lindsay MBA, CFA - Director

Founder and CEO of Otis Gold Corp (TSXV: OOO) and a current director of Excellon Resources, VR Resources and Alianza Minerals. Prior to Otis, was Founder and CEO of Magnum Uranium Corp and led its sale to Energy Fuels Inc. (TSX: EFR). In excess of 30 years’ experience in corporate finance, investment banking and business development.

Robert Schafer P.GEO - Director

Co-founding director of International Royalty Corp (sold for $800m to Royal Gold). More than 30 years of experience working internationally in business development roles with major and junior mining companies including formerly representing as Chairman of PDAC. Serves as a director of a number of public resource companies.