Overview

The global battery metals market is a rapidly growing billion-dollar industry. This market represents the raw materials used in the production of batteries such as lithium, nickel, cobalt, manganese and graphite. With the increasing popularity of electric vehicles, energy storage systems, consumer electronics and electric alternatives to everyday applications, the demand for these metals has seen unprecedented growth.

The global battery metals market value is expected to reach $20 5 billion in 2027 with a CAGR of 8.2 percent. A rapid surge in the renewable energy industry has many looking to the battery mineral and metal exploration and development companies to supply the demand, which shows robust projections across global markets.

Battery Mineral Resources (TSXV:

BMR,OTCQB:BTRMF) is a Canadian multi-commodity resource company focused on exploring, mining and bringing essential battery minerals to market through project development and production. Its unparalleled management team and high-quality asset portfolio set the company apart from other emerging battery metals players.

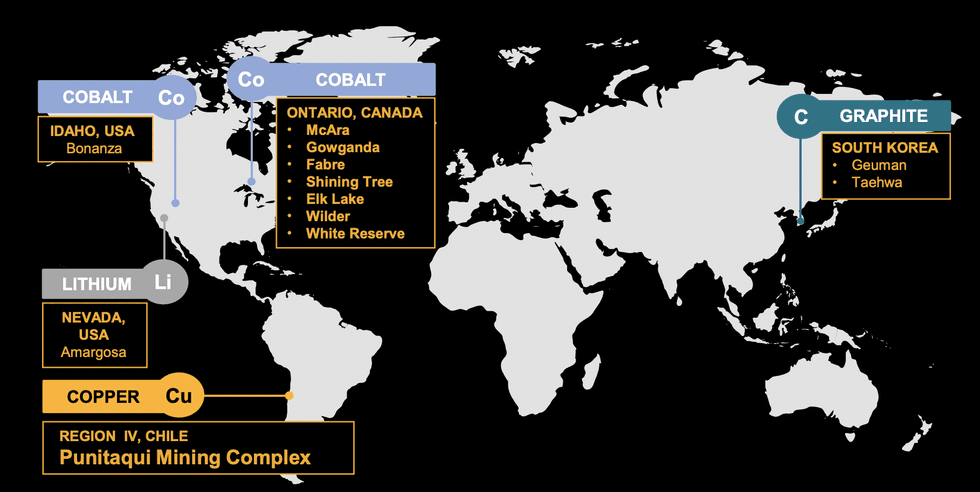

BMR stands as the largest claim holder across all minerals in the Ontario Cobalt Belt, which is one of the most richly endowed mining regions in the world. It currently has a robust asset portfolio, including its McAra, Gowganda, Iron Mask, Island 27 projects in Ontario and additional projects in the works across the province and Quebec. As a first-mover in the district, the company has led efforts in recognizing the potential of multiple new, at-surface and high-grade primary cobalt discoveries in this region.

In March 2021, BMR acquired the near-term cash flow Punatiqui Mine Complex in Chile, which consists of a centralized process plant fed by four satellite copper deposits — San Andres, Cinabrio, Dalmacia and Los Mantos. The past-producing mining operation leverages easy road access to local population centers and presents outstanding exploration opportunities across its classic IOCG and manto style copper-gold-silver veins.

The company's cobalt reach extends into the prolific mining district of Idaho with its three 100 percent owned properties covering 14 significant cobalt prospects in the state. Bonanza, Desert and East Fork properties are strategically positioned near the home of eCobalt Solutions Idaho cobalt project, the only advanced stage, near term, environmentally permitted, primary cobalt deposit in the U.S.

Another exciting addition to the BMR portfolio is its highly prospective graphite assets located in South Korea and lithium assets in prolific US mining districts. The Guemam and Taehwa projects are two past-producing graphite mines, which leverage close proximity to excellent lithium-ion industrial infrastructure and considerable yield and high-grade graphite potential.

BMR closed a sale-leaseback transaction on an industrial property located at 7102 West Sherman Street, Phoenix, Arizona. The property was previously held by Ozzie’s, Inc. subsidiary of BMR’s 100 percent-owned ESI Energy Services, Inc., which operates in the equipment rental and sales sector of the pipeline and renewable energy space. The company is well positioned to focus on growth through cash-flow, exploration and acquisitions in the world’s top mining jurisdictions with a cash position of C$4 million non diluted market capitalization of C$30 million.

Battery Mineral Resources’ management team consists of leaders with extensive operational and development experience. Combined with a stellar and supportive shareholder portfolio, the company is primed for exceptional economic growth and well-funded development.

Company Highlights

- Battery Mineral Resources is a multi-commodity resource company focused on discovering, acquiring and developing battery metals projects (cobalt, lithium, graphite, nickel & copper), in North and South America and South Korea. It's poised to become a premier and sustainable supplier of battery minerals to the electrification marketplace.

- BMR is currently developing the Punitaqui Mining Complex and pursuing the potential near-term resumption of operations at the prior producing Punitaqui copper-gold mine.

- BMR is the largest mineral claim holder in the historic Gowganda Cobalt-Silver Camp, Canada. It controls a robust portfolio of cobalt assets across the prolific Timmins & Sudbury and Rouyn & Val d'Or Quebec areas.

- Its Canadian cobalt portfolio consists of McAra and Gowganda with Elk Lake located about 150km northeast of Sudbury

- Additional battery mineral exposure includes its strategically acquired graphite assets in South Korea and a lithium property in the prolific mining district of Nevada.

- BMR's management team combines seasoned experts across related industries in finance, resource development and battery mineral exploration.

- BMR closed a C$4 million sale-leaseback transaction on an industrial property in Arizona.

Key Projects

Punitaqui Mine Complex

The Punitaqui Mine Complex is an integrated copper and gold mining complex located in the region of Coquimbo, Chile approximately 50km south of the Andacollo copper mine owned by Teck Resources. The 8,095-hectare asset consists of a centralized process plant that is fed by four satellite copper deposits – San Andres, Cinabrio, Dalmacia and Los Mantos. The fully permitted operation also leverages excellent road access and widespread mineralization.

The Punitaqui Mine Complex boasts a past production history and near-term production potential. Cinabrio and San Andres mining zones leverage underground portal access and Mantos-type copper mineralization up to 30 meters thick. The Dalmacia drill target contains copper-silver-gold mineralization which is structurally controlled. All regional targets offer immediate exploration and district-scale potential to BMR.

- Location - ~120 km south of La Serena city and the port of Coquimbo, Chile and is positioned at lower elevations (~ 650 m.a.s.l.). The process plant is centrally located and is proximal to four satellite copper sources which are drill ready resource targets and underground development

- Capacity - The process plant is currently permitted for 3,200 tpd and has allowances of up to 3,600 tpd

- Processing - Standard copper sulphide crush/grind/float processing to produce a Cu–Au-Ag concentrate

- Infrastructure

- Water and power from local sources and local supplier

- A key advantage vs. most operators in Chile Tailings containment

- Currently a series of dams and transitioning to dry tailings to extend life of storage areas and to be more water efficient

After its acquisition in March 2021, BMR has been quick to begin development on the asset. The company completed Phase 1 drill program at the Punitaqui Mining complex in May 2022 with all assays received and reported. The final tally for the Phase 1 program totalled nearly 33,000 meters of diamond drilling focusing on three zones: San Andres, Dalmacia and Cinabrio Norte.

On August 16, 2022, BMR released its resource update for Punitaqui that included underground indicated and inferred resources for Cinabrio, Cinabrio Norte, San Andres, Dalmacia and the remnant pillars at the Cinabrio mine.

BMR is set to restart the Punitaqui project within 9-12 months of formal production

Decision for a potential annual EBITDA of US$40-50 million and a re-rating in enterprise value to between 3.5x to 5.5x EBITDA.

Canadian Cobalt Exploration Projects

BMR controls a large 1,100-kilometer squared land package in the Ontario Cobalt Belt, which hosts multiple high-grade and widespread mineralized targets. The company has conducted geotechnical assessments and assays on the property with samples from outcrop revealing target prospects that present up to 21 percent cobalt values.

The project portfolio consists of McAra, Gowganda, Iron Mask, Island 27, other additional Ontario properties and highly prospective cobalt assets in Quebec. The projects access well-serviced mining networks and infrastructure with excellent exploration, development and mining suppliers in the prolific Timmins & Sudbury and Rouyn & Val d'Or Quebec areas. BMR stands as the largest regional landholder with extensive claim packages in the Elk Lake and Gowganda mining camps.

Over 42,244 meters have been drilled on 20 cobalt-silver prospects across seven properties. McAra has a measured and indicated resource of approximately 1,124,000 pounds of cobalt and stands as the highest-grade cobalt dominant deposit worldwide in more than 50 years with grades upwards of 1.5 percent cobalt. Exciting next steps for the company's Ontario cobalt assets include a 9,000-meter drilling program and a projected centralized processing plant at Gowganda.

Idaho Cobalt Projects

Battery Mineral Resources has 434 mineral claims in three 100 percent owned properties covering fourteen significant cobalt prospects within a three by six kilometer cobalt-copper mineralized zone. Its properties include Bonanza, Desert and East Fork assets located in the historic cobalt-copper Blackbird mining district approximately 30 kilometers west of Salmon, Idaho.

The largest Bonanza hosts multiple surface and subsurface shoots of copper-cobalt mineralization hosted along contact with gabbro sill. Historic drilling results demonstrated cobalt grades ranging from 0.4 percent to 0.58 percent with anomalous gold from surface level to 100 meters deep. All projects host excellent high-grade copper-cobalt discovery potential.

Geumam and Taehwa, South Korea

BMR has 100 percent ownership of Guemam and Taehwa graphite exploration projects containing high-purity flake graphite deposits. Both assets are past-producing mines with existing local infrastructure and near-term production potential. Advantageous positioning in South Korea puts BMR close to established and booming battery industries in Asia.

Guemam is located 20 kilometers from South Korea's second-largest lithium-ion battery factory and has a maiden NI 43-101 resource. Indicated mineral resources on the property stand at approximately 101-kilo tons containing 6.6 percent graphite grades. The Taehwa project also has excellent discovery potential with historical mineral resource estimates of 99,000 tons of graphite at 6.8 percent and additional inferred mineral resource of 70,000 at seven percent graphite grades.

ESI Energy Services

The ESI Energy Services is a wholly-owned energy services company based in Phoenix and is currently generating C$4M - C$5M in EBITDA per year. ESI is operating in the business of renting and selling backfill separation solutions and services for mainline and small diameter pipeline construction, wind and solar utility scale construction projects, civil construction and telecom/utilities. ESI’s wholly-owned US subsidiary Ozzie’s Inc. produced the first pipeline padding machine in the 80s and has been an industry leader ever since.

ESI has an impressive fleet of specialized rolling stock valued at C$14 million and provides BMR with year-round cash flow and could be monetized by a full or partial divestment.

Management Team

Lazaros Nikeas - Executive Chairman

Lazaros Nikeas has over 15 years of strategy and capital markets advisory for resource, chemicals and industrial companies, with over US$25 billion of M&A transactions completed. He is currently a principal investment manager of Weston Energy LLC, a Yorktown Partners LLC portfolio company with investments in energy minerals assets. Nikeas was previously a partner of Traxys Capital Partners, a private equity firm backed by The Carlyle Group.

Martin Kostuik - CEO & Director

Martin Kostuik has over 28 years of diversified experience in the mining industry as a mining engineer and senior executive. He was the president and director for the last four years at Arizona Gold Corporation and before was CEO and director of Rupert Resources Limited.

Previously, Kostuik built a broad base of experience in operations, engineering, exploration and capital projects with various companies including Luna Gold (Equinox), Barrick Gold Corporation, Taseko Mines Limited and DMC Mining Services.

Max Satel - Chief Financial Officer

Max Satel is a successful natural resources-focused executive, with over 18 years' experience catalyzing results in demanding, highly competitive environments, with extensive experience and expertise in sourcing, structuring and implementing data- and analysis-driven solutions that position companies for growth and out-performance.

Mr. Satel has held financial leadership positions of increasing responsibility throughout his career, in the process demonstrating the ability to raise significant new capital towards resource projects, create and implement financial strategies to ensure the achievement of company objectives, delivering timely and accurate budgets and forecasts, as well as financial reports in accordance with applicable accounting standards, implementing and improving internal controls, driving corporate cost savings, and launching new corporate initiatives to create sustained value

Peter Doyle - VP of Exploration

Peter Doyle has over 40 years of experience in all aspects of mineral exploration from regional reconnaissance to project evaluation and development, in a variety of geological terrains throughout Canada, the U.S., South America and Australia. He was previously with PT Freeport Indonesia, Gold Fields and Troy Resources.

Jacob Willoughby - VP of Corporate Development & Strategy

Jacob Willoughby is a geologist and MBA graduate with nearly 17 years of diversified experience in mining capital markets. He has worked as a mining analyst for over eight years, covering exploration and development companies globally in both precious and base metals. Mr. Willoughby also worked as a capital markets consultant, an investor and as a director and senior executive. Most recently, he was VP of Research and Analyst at Red Cloud Securities in Toronto. Prior to that, he was a partner and mining analyst at Beacon Securities. He began his career in mining equity research at Paradigm Capital, where he worked for five years. He also spent two years as President and Director of Aldridge Minerals, a Canadian public company with assets in Turkey and Papua New Guinea.

Hector Arenas – Country Manager, Chile

Hector Arenas is a mining engineer with over 30 years of experience in the financial and mining industry as a senior executive and financial advisor based in Lima Peru. He was previously General Manager and Director for six years at Compania Minera San Valentin and prior to that was Corporate Finance Manager at Banco Wiese Sudameris, the third largest bank in Peru at the time. Mr. Arenas has participated in a broad number of exploration projects with various companies including Trevali Resources, Cardero Resources, Indico Resources and was involved in project construction, permitting community relations and financial structuring.

Derek White – Director & Advisor

Derek White has over 30 years of experience in the mining and metals industry. He holds an undergraduate degree in Geological Engineering from the University of British Columbia and is also a Chartered Accountant. Prior to joining Ascot Resources, Mr. White, was the Principal of Traxys Capital Partners LLP, a private equity firm specializing in the mining and minerals sectors. Mr. White was President and CEO of KGHM International Ltd. from 2012 to 2015, and held the positions of Executive Vice President, Business Development and Chief Financial Officer of Quadra FNX Mining Ltd. from 2004 to 2012. Mr. White has held executive positions with International Vision Direct Ltd., BHP-Billiton Plc, Billiton International Metals BV and Impala Platinum Ltd., in Vancouver, Toronto, London, The Hague, and Johannesburg. Mr. White is also an ICSA Accredited Director.

Julia B. Aspillaga Rodriguez - Director

Julia Aspillaga Rodriguez studied at the Pontifical Catholic University of Chile, graduating as an English teacher in 1977, then completed studies and graduated in Business Administration in 1979. Miss Aspillaga has participated in the discovery and development of several mining projects, including as a partner of Dr. David Lowell in the San Cristobal gold project, in Region II, Chile at the end of the 1980's. In the 1990's she was manager of Bema Gold in Chile, a company that developed the Refugio gold deposit in Region III, Atacama-Chile, that was previously exploited by Kinross Gold Corp. (Canada). From the year 2000 to date, Miss Aspillaga has participated as manager and/or management advisor for various international companies including Mineral Resource Development (Great Britain), Yorkton Securities (Canada), Endeavour Financial (Canada), Galileo Minerals (Canada), and Global Hunter Corp (Canada).

Click here to follow Battery Mineral Resources on LinkedIn