- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

Trident Royalties PLC

International Graphite

Carbon Done Right

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Moly prices today are holding fairly steady since a steep June drop off.

At the end of 2014, moly market watchers were predicting positive price action for the metal at the beginning of 2015, with lower prices taking over in the latter half of the year.

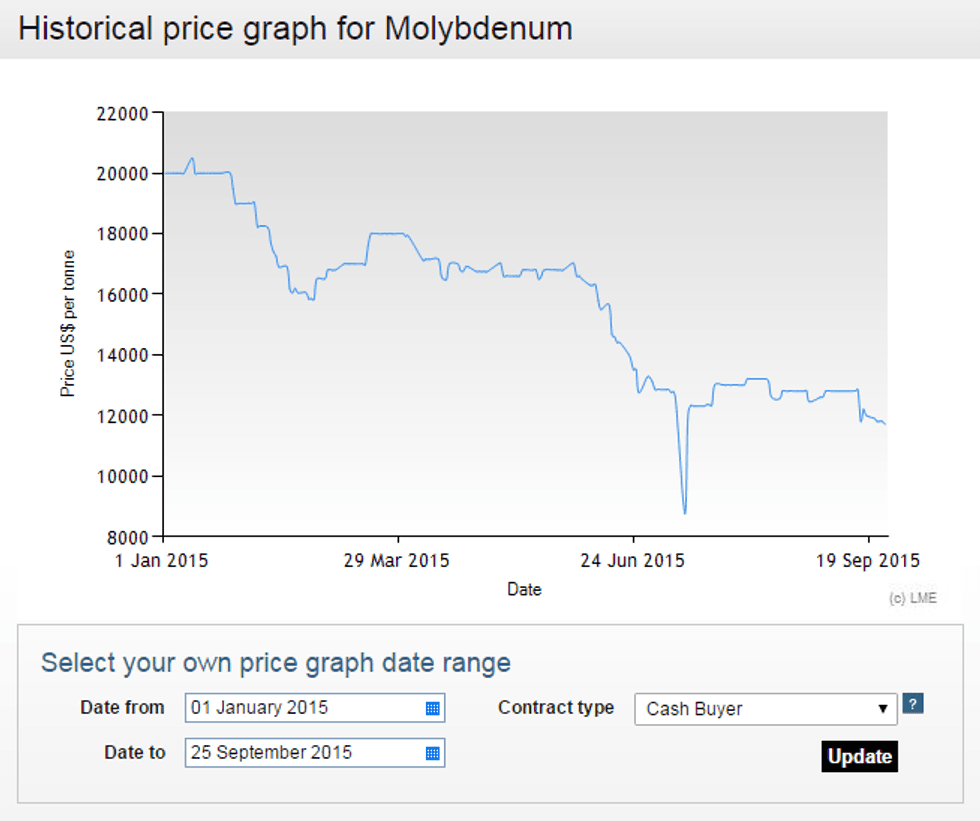

As it turns out, those predictions were correct, but only to a point. As the below chart from the London Metal Exchange shows, moly prices ticked upward very briefly at the start of 2015, only to fall steeply later in Q1. And while prices for the metal were able to hold steady during Q2, at the end of June they plunged steeply again.

In terms of moly prices today, one bright side is that since that June drop off, they are steady once again. Most recently, Platts reported midway through September that the daily European ferromoly price was level at $14.40 to $14.80 per kilogram.

Oxide prices were faring less well at that time, and were assessed at $5.55 to $5.70 per pound, down from $5.60 to $5.75. And unfortunately, little improvement is expected in that arena in the near term — as one seller told the news outlet, market participants “know the oxide price is coming down.”

While that might sound bleak, it’s worth noting that the long-term outlook for moly prices is positive. One report published at the end of last year states that China’s moly consumption will hit 120,000 tonnes in 2015, reaching 135,000 tonnes by 2020. And though supply is also expected to rise, the report concludes that a healthy increase in both supply and demand could lead to “a price rebound by [2020].”

More recently, CPM Group said that while a “[l]ooming surplus” is likely to keep prices subdued through to 2016, after that the outlook for the metal becomes a little brighter.

Company news

Last week, MOAG Copper Gold Resources (CSE:MOG) provided an update on the drill campaign at its Ireland-based Mace moly-copper project. Since July, the company has drilled 1,920 meters out of a planned 5,000 meters, focusing on an altered, northeast-trending zone of mineralization.

At this point, nine holes have been completed, and results for two have been received. According to the company, they point to “significant molybdenum-copper-silver mineralization.” MOAG believes Mace has the potential to grade 0.1 percent moly plus 0.07 percent copper.

Also last week, Alloycorp Mining (TSXV:AVT) announced that President and CEO Gordon J. Bogden has resigned as CEO to pursue other interests. He will also step down from his position on Alloycorp’s board of directors.

Alloycorp is focused on the British Columbia-based Avanti Kitsault project, which it expects to bring into production in 2017. The company anticipates Avanti Kitsault becoming one of the world’s four top primary moly mines, with average annual production of 11,300 tonnes of moly and over 1 million ounces of silver.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Moly Outlook 2015: First Half of Year May Bring Price Bump

CPM Group: Look Longer Term for Moly Price Upside

Outlook Reports

Featured Industrial Metals Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2311.01 | -22.38 | |

| Silver | 27.05 | -0.27 | |

| Copper | 4.43 | -0.07 | |

| Oil | 81.54 | -0.36 | |

| Heating Oil | 2.54 | -0.02 | |

| Natural Gas | 1.75 | -0.04 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.