- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Deep-South Resources has Closed the Acquisition of 100% of Haib Copper Deposit in Namibia in Partial Share Deal

Deep-South Resources Inc. (“Deep-South” or “the Company”) (TSX-V: DSM) is pleased to announce that it has closed the acquisition of the remaining 70% of Haib Minerals (Pty) Ltd. (“Haib Minerals”) that it does not own.

Deep-South Resources Inc. (“Deep-South” or “the Company”) (TSX-V: DSM) is pleased to announce that it has closed the acquisition of the remaining 70% of Haib Minerals (Pty) Ltd. (“Haib Minerals”) that it does not own. The shares were acquired from Teck Namibia Ltd. (“Teck”), a wholly owned subsidiary of Teck Resources Limited in exchange for, among other things, 14,060,000 common shares of Deep-South. Deep-South now holds 100% of Haib Minerals. Haib Minerals holds the Exclusive Prospecting Licence 3140 (“EPL 3140”), which hosts the Haib copper project (“Haib” or “the Property”) situated in the south of Namibia. Teck now holds 18,226,667 of the common shares of Deep-South, representing about 35% of the Company’s share capital based on the common shares currently outstanding.

In addition to the Deep-South shares to be issued to Teck, Deep-South shall:

– pay $400,000 to Teck in accordance with the following schedule:

– First anniversary of the agreement: $200,000

– Second anniversary of the agreement: $200,000

- –Teck shall hold a pre-emptive right to participate in any financing of Deep-South as long as Teck holds over 5% of Deep-South’s outstanding common shares;

- –Teck shall be granted a 1.5% NSR. Deep-South shall have the option to buy back 1/3 of the NSR in consideration for $ 2 million;

- –If Deep-South sells or options the Property or a portion of the Property during the 36 months following closing, Teck shall receive 30% of the gross proceeds of the sale if the sale occurs during the first 24 months after the closing and shall receive 20% of the gross proceeds if the sale occurs between the 24th and 36th month after closing;

- –Teck shall be entitled to a production bonus payment that will be declared at the time the company takes the decision to start mine development. Half of the bonus shall be paid upon the decision to start mine development and the second half shall be paid upon commencement of commercial production. The bonus value is scaled with the value of the capital expenditures as follows:

| Development Expenditures (CAD$M) | Cash Payment (CAD$M) |

| $0 – $500 | $5.0 |

| $501 – $600 | $6.7 |

| $601 – $700 | $8.3 |

| $701 – $800 | $10.0 |

| $801 – $900 | $11.7 |

| $901 – $1,000 | $13.3 |

| $1,001 and over | $15.0 |

This transaction constitutes a fundamental change under the policies of the TSX Venture Exchange. As required by the TSX Venture Exchange, the transaction has been approved by a shareholders resolution representing 62.26% of the shares issued and outstanding on March 17, 2017.

Mr. John Akwenye, Chairman of Deep-South stated, “We are delighted with this transaction. Haib is the largest known porphyry copper deposit in Africa and is situated in an ideal location adjacent to modern infrastructure and in one of the best mining countries in Africa. In becoming our largest shareholder, Teck is a strong shareholder to have in support of the Company. Haib has substantial exploration potential and is a quality asset that adds strong value for our shareholders.”

About the Haib Copper Project:

The Haib project is a large copper-molybdenum porphyry deposit located in the Karas region of southern Namibia, 8 km from the Orange River and the South African border.

The deposit, discovered in the 1950’s, has seen over 50,000 metres of drilling in the 1970’s by companies such as Rio Tinto and Falconbridge Ltd.

Since 2010, Teck Namibia has completed over 14,000 metres of drilling with results such as: 121 m @ 0.5% Cu, 494 m @ 0.36% Cu and 30 m @ 0.81% Cu.

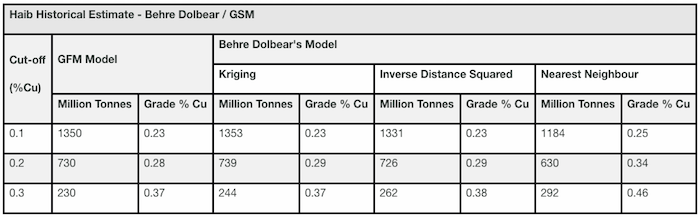

A report by Behre Dolbear, completed in 1996, estimated an Historical Estimate at Haib in a range as presented in the table below:

(The Behre Dolbear report was produced from a geostatistical block model completed in 1996 by Great Fitzroy Mineral NL (“GFM”)). GFM and Behre Dolbear models used the Kriging method as the basis for their estimate calculations. Kriging is a statistical estimation technique widely used for porphyry deposits. The Inverse Distance Squared and Nearest Neighbour methods, were used by Behre Dolbear for validation of the Kriging method estimates.

The Historical Estimate comprised principally the compilation and verification of all the drillhole data incorporating all available data to the end of the Rio Tinto Zinc program completed in 1975 and comprising over 50,000 metres of drilling, assays and surveys.

The estimates of tonnages and grades quoted in this report were prepared prior to publication of National Instrument 43-101 in 2001 and are considered as Historical Estimates.

The historical grades and resources terminology from the original historical reports are to be used only as a reference and should not be considered as a current mineral resource under NI 43-101 but are to be considered as Historical Estimates as per the NI 43-101 Rules and Policies. Deep-South is not treating the Historical Resource as a current mineral resource under NI 43-101.

P & E Walker Consultancy (“The consultant”), were engaged to prepare a technical review of all the historical data and reports and to act as Qualified Person. The Consultant did not have the mandate to classify the Historical Estimate as current mineral resource under NI 43-101.

P & E Walker Consultancy has prepared a technical review of all the historical data and reports. The NI 43-101 qualification report can be found on SEDAR at www.sedar.com.

Peter Walker B.Sc. (Hons.) MBA Pr.Sci.Nat. is the author of the 43-101 qualifying report and is responsible for the technical part of this press release, and is the designated Qualified Person under the terms of National Instrument 43-101.

About Deep-South Resources Inc.

Deep-South Resources Inc. is a mineral exploration company with a large Namibian shareholding, actively involved in the acquisition, exploration and development of major mineral properties in Namibia and Canada. Deep-South growth strategy is to focus on the exploration and development of quality assets, in significant mineralized trends, close to infrastructure, in stable countries.

This press release contains certain “forward-looking statements,” as identified in Deep-South’s periodic filings with Canadian Securities Regulators that involve a number of risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

More information is available by contacting Tim Fernback at 604.340.3774 or at info@deepsouthresources.com.

Click here to connect with Deep-South Resources Inc. (TSXV:DSM) to receive an Investor Presentation.

Source: www.thenewswire.com

Outlook Reports

Featured Base Metals Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2406.95 | +27.02 | |

| Silver | 28.74 | +0.50 | |

| Copper | 4.46 | 0.00 | |

| Oil | 85.91 | +3.18 | |

| Heating Oil | 2.64 | +0.09 | |

| Natural Gas | 1.78 | +0.02 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.