American CuMo Mining Announces CuMo Deposit Amenable to Significant Upgrading Using Ore-Sorting

American CuMo Mining Corporation (TSXV:MLY,OTCPINK:MLYCF) announced excellent positive results from utilizing Ore-Sorting technology on samples from its CuMo deposit located in Idaho.

American CuMo Mining Corporation (TSXV:MLY,OTCPINK:MLYCF) announced excellent positive results from utilizing Ore-Sorting technology on samples from its CuMo deposit located in Idaho. Preliminary results reported by Sacre-Davey Engineering clearly establish that mineralization at the CuMo deposit is amenable to significant upgrading using Ore-Sorting technology.

As quoted in the press release:

The CuMo deposit has long been recognized as a stockwork vein deposit, consisting of narrow veins containing molybdenum and/or copper mineralization, surrounded by discard/waste material. With this vein mineralization structure, excellent metallurgical recoveries can be achieved with the latest Ore-Sorting technology, even at lower-grade levels. CuMoCo is performing larger bulk tests on its CuMo material with STEINERT Elektromagnetbau GmbH (www.steinertglobal.com), a world-recognized leader in Ore-Sorting with numerous installations worldwide.

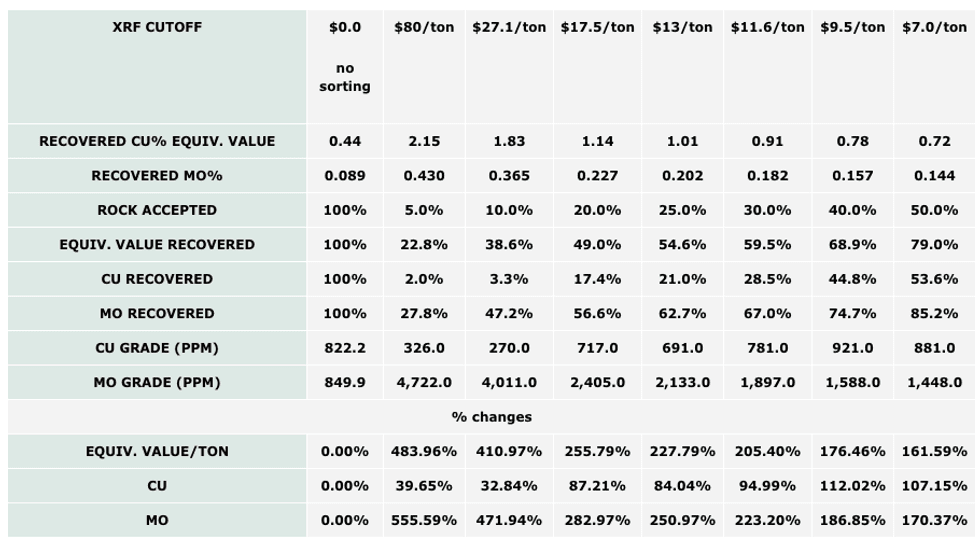

New Ore-Sorting technology uses sophisticated X-ray technology (XRF/XRT) to identify rocks that contain processing grade minerals and separates them from those that do not. Previous methods of visual ore-sorting can now be performed with much greater accuracy and efficiency. Rock is placed on a conveyor belt following primary crushing (10 to 200 mm). It is then scanned, and based on a grade/value cutoff, either accepted for processing or rejected.

Overall preliminary results indicate that by incorporating modern Ore-Sorting technology, CuMoCo can mine large tonnages of 150K to 250K per day while requiring only smaller tonnages of 50K to 100K per day to recover the majority of its metals. The overall objective is to have 25 to 50% of the material recovering 85 to 95% of the value, substantially increasing profitability and reducing capital and operating costs. Using the values in the PEA, a reduction in processing size from 150K to 50K per day could achieve a CAPEX savings for the CuMo Project of between US$800 million and US$1 billion, substantially reducing the cost per pound of molybdenum, net of by-products copper, silver and rhenium.

The following table shows the results of the preliminary testing for various Ore-Sorting scenarios, based on the amount of rock accepted for processing.

American Cumo President and CEO, Shaun Dykes, stated:

Ore-Sorting marks the first of several optimizations for the CuMo deposit in preparation for its Feasibility Study. The updated resource calculation and Preliminary Economic Assessment (PEA) (November 8, 2015) combined with the excellent Ore-Sorting results show the potential of CuMo to compete on a cost-to-produce basis with not only primary molybdenum producers but also with copper projects producing molybdenum as a by-product. The results also provide support for CuMo’s potential as a large-scale, low-cost producer of molybdenum with significant copper, silver and rhenium by-products.