Margaux Resources Announces Acquisition Of The Bayonne And Sheep Creek Properties In Southeastern British Columbia

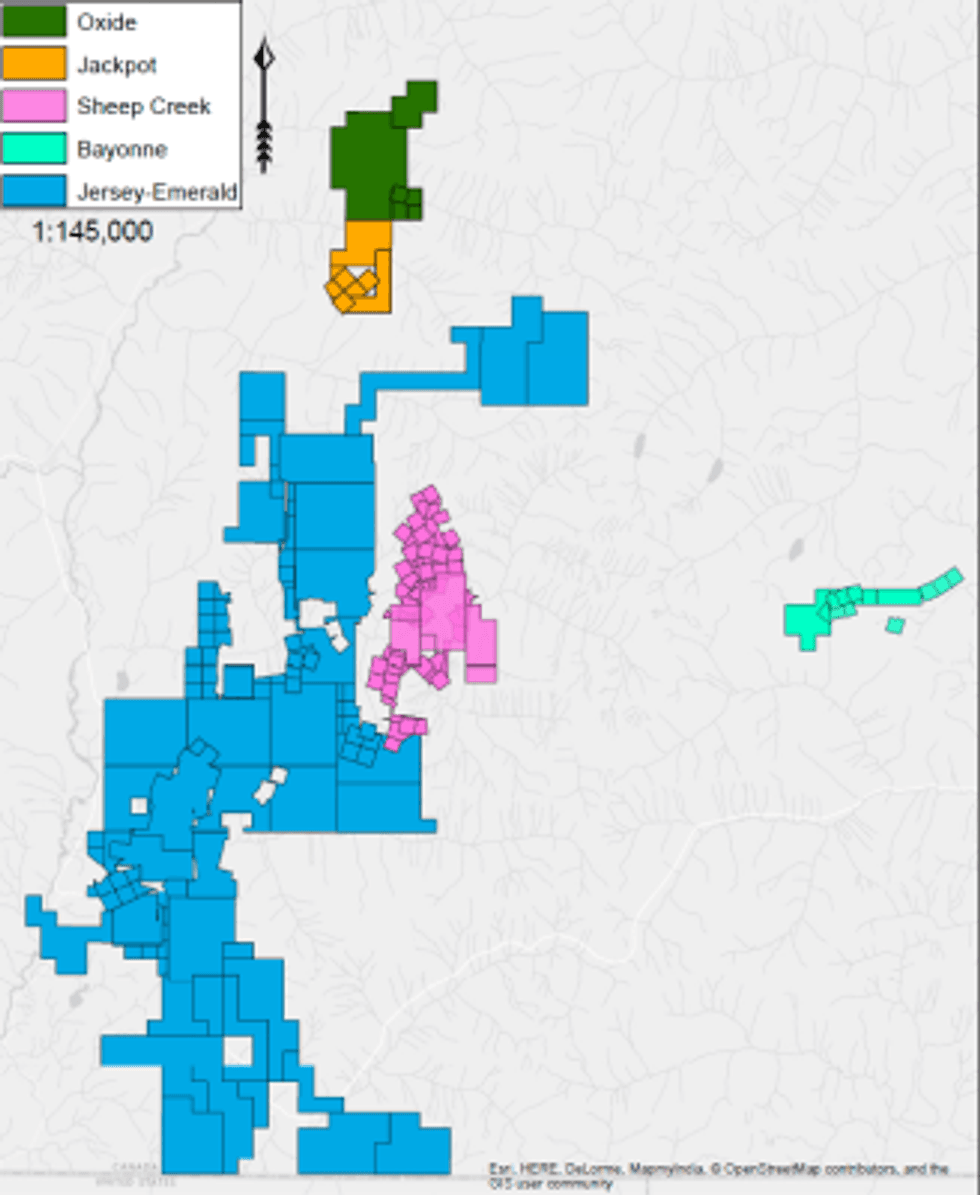

Margaux Resources Ltd. (TSXV:MRL; OTCQB:MARFF) is pleased to announce that it has entered into an option agreement (the “Option Agreement”) with Yellowstone Resources Ltd. (a private company, based in British Columbia) for the acquisition of 100% of the Bayonne and Sheep Creek properties (the “Properties”), located in Salmo, BritishColumbia.

Margaux Resources Ltd. (TSXV:MRL; OTCQB:MARFF) is pleased to announce that it has entered into an option agreement (the “Option Agreement”) with Yellowstone Resources Ltd. (a private company, based in British Columbia) for the acquisition of 100% of the Bayonne and Sheep Creek properties (the “Properties”), located in Salmo, BritishColumbia.

“We are extremely excited to be adding the Bayonne and Sheep Creek properties to our portfolio,” commented Company CEO and President, Tyler Rice.”These gold and silver prospective properties are the latest high-quality acquisitions in Margaux’s Kootenay Arc regional consolidation plan, providing diversity to our portfolio within our core operating area.”

Margaux’s continuing evaluation of the Jersey-Emerald mine and the recent acquisition of the Jackpot/Oxide properties has encouraged the Company to acquire additional properties in the immediate vicinity of its Jersey-Emerald mine. “With this acquisition, Margaux is pursuing a regional consolidation strategy targeted at prospective historical mining sites proximal to Margaux’ core assets, where we believe there is likely to be untappedpolymetallic mining opportunities. Much of the historic mining in this region dates back prior to the turn of the century, when modern exploration and mining technologies were not available, leaving high potential for unexploited opportunities. Today the Kootenay region is also supported with well-developed infrastructure and easy access to nearby smelters and processing facilities” said Mr. Rice.

The Bayonne and Sheep Creek properties are located approximately 42 kilometres and 12 kilometres, respectively, east of Salmo, BC. The Properties consist of 79 Crown granted claims (1,083 ha) and 13 mineral cell claims (972 ha) in the Nelson Mining Division, and are prospective for gold and silver.

The Properties form part of the Kootenay Arc belt in southeastern British Columbia, a northerly trending arcuate structural zone, which includes Proterozoic to Ordivician sedimentary rocks which have been intruded by igneous granitic rocks of the Nelson batholith. It is believed that these intrusives are related to the gold silver mineralization found in the Bayonne and Sheep Creek properties. The belt is characterized by open to isoclinal north-trending folds in the oldest sedimentary rocks, which contain stratisform zinc-lead-silver deposits in Cambrian limestones and dolomites and gold deposits in quartz veins, filling late crossfaults.

Historically, the Bayonne property produced 81,782 tonnes, grading 16.0 g/t gold (42,174 ounces) and 45.9 g/t silver (120,665 ounces)(1).

The Sheep Creek property (Motherlode, Reno, Nugget, Goldbelt and Queen) produced 632,590 ounces of gold with an averagegrade of 15.12 g/t Au from the Reno, Queen, Goldbelt, Nugget, and Motherlode mines, and 252,461 ounces of silver(2).Between 1899 and 1951 the Sheep Creek Camp exposed 55 Au bearing quartz veins distributed over a roughly 8 kilometres north-south trend. It is noted that 34 of the 55 veins have been past producers.

The Property has the following historic resource:

------------------------------------------------ |Bayonne(1)(after Dunn, D., 2008) | |----------------------------------------------| |Measured&Indicated|29,730 tonne |12.8 g/t gold| |----------------------------------------------| |Inferred |95,000 tonne |14.9 g/t gold| |----------------------------------------------| |Sheep Creek(3)(after Price, B., 1988) | |----------------------------------------------| |Proven |36,391 tonne |13.4 g/t gold| |----------------------------------------------| |Probable |31,908 tonne |18.2 g/t gold| |----------------------------------------------| |Possible |114,572 tonne|9.6 g/t gold | -----------------------------------------------

Note: The reader is cautioned that a qualified person has not done sufficient work to classify the historical estimate as current resources and Margaux is not treating the historical estimate as current mineral resources. The resource/reserve categories disclosed in the historical estimates are not consistent with current definitions. While we believe the estimates were completed to the standards of the day they do not use current mineral resource and reserve categories as required by NI 43-101. The historic resource includes 1,179.2 t at 5.3 grams per tonne in the proven category which is a stockpile owned by an unrelated 3rdparty and not included in this transaction.

Margaux has not completed any exploration work on the Properties, and the mineralization that is reported to occur therein is known only from the abundant underground and surface work, dating back to the late 19thcentury and from reports by third parties. Acquiring the option to purchase the Properties provides Margaux time to further evaluate and explore the historic production and future potential of the Properties.

The Company plans to utilize the data mining process established on the Jersey-Emerald and Jackpot/Oxide to assist with the vetting of the Bayonne and Sheep Creek properties. By applying this methodical approach to the Bayonne and Sheep Creek properties, Margaux will move the historical data into a format suitable to utilize the best of industry technology to gain the most accurate understanding of the resource.

Under the terms of the Option Agreement, Margaux will have the exclusive option to acquire the Bayonne property, by making payments to Yellowstone Resources Ltd. of an aggregate $194,000 cash and aggregate issuance of 550,000 shares, paid in several installments as follows:

- within ten (10) business days of execution of the Option Agreement, a non-refundable cash payment of $5,000;

- 2)within ten (10) business days of completion of title due diligence on the Properties, a cash payment of $9,000;

- upon receipt of TSX Venture Exchange approval, a cash payment of $10,000 and issuance of 50,000 shares;

- on or before the first anniversary of TSX Venture Exchange approval, a cash payment of $30,000 and the issuance of 150,000 shares;

- on or before the second anniversary of TSX Venture Exchange approval, a cash payment of $60,000 and issuance of 150,000 shares;

- on or before the third anniversary of TSX Venture Exchange approval, a cash payment of $80,000 and issuance of 200,000 shares.

Margaux will have the exclusive option to acquire the Sheep Creek property by making payments to Yellowstone Resources Ltd. of an aggregate $500,000 cash and aggregate issuance of 1,050,000 shares, paid in several installments as follows:

- upon receipt of TSX Venture Exchange approval, a cash payment of $25,000;

- on or before six months, following TSX Venture Exchange approval, a cash payment of $25,000;

- on or before the first anniversary of TSX Venture Exchange approval, a cash payment of $25,000;

- on or before eighteen (18) months following, TSV Venture Exchange approval, a cash payment of $25,000;

- on or before the second anniversary of TSX Venture Exchange approval, a cash payment of $100,000 and issuance of 300,000 shares;

- on or before the third anniversary of TSX Venture Exchange approval, a cash payment of $100,000;

- on or before the fourth anniversary of TSX Venture Exchange approval, a cash payment of $100,000 and issuance of 300,000 shares;

- on or before the fifth anniversary of TSX Venture Exchange approval, a cash payment of $100,000 and issuance of 450,000 shares.

There can be no assurance that the Company will complete the option payments to acquire the Properties on the time frame required by the Option Agreement or at all. The payments under the Option Agreement are subject to a number of conditions, including Margaux obtaining requisite TSX Venture Exchange approval and being able to source the cash required under the Option Agreements to make the requisite option payments.

Richard Kilpatrick, P.Geo, the Company’s Vice President of Exploration, a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained within this press release.

Sources

- Dunn, D., 2008: Technical Report on the Sheep Creek, Bayonne, Ymir and Rossland Mining Camps, Yellowstone Resources Ltd., Private company report.

- Kushner, W, 2013: Geochemical Assessment Report on the Sheep Creek / Bayonne Property, Yellowstone Resources Ltd, Private company report.

- Price, B. (P. Geo.), 1988. Geological Summary Report Nugget Mine Sheep Creek Area prepared for Gunsteel Resources Inc.

About Margaux Resources Ltd.: Margaux is a publicly traded mineral exploration company focused on the exploration and development of previously producing properties in the Kootenay Arc, located in southeastern British Columbia, including the Jersey-Emerald and Jackpot/Oxide properties, on which Margaux has options. The Company is directed by a group of highly successful Canadian businessmen with proven track records. Margaux trades on the TSX Venture Exchange under the symbol MRL and on the OTCQB under the symbol MARFF.

Forward Looking Statements

This press release may contain forward looking statements including those describing Margaux’s future plans and the expectations of management that a stated result or condition will occur. Any statement addressing future events or conditions necessarily involves inherent risk and uncertainty. Actual results can differ materially from those anticipated by management at the time of writing due to many factors, the majority of which are beyond the control of Margaux and its management. In particular, this news release contains forward-looking statements pertaining, directly or indirectly, to the following:Margaux’s exploration plans and work commitments, the receiptof required regulatory and other approvals, the potential of mineral resources and potential for recovery thereof, the continual development availability of new and improving methods of mineral recovery, Margaux’s future plans for further acquisitions, as well as other market conditions and economic factors, business and operations strategies. Readers are cautioned that the foregoing list of risk factors should not be construed as exhaustive. These statements speak only as of the date of this release or as of the date specified in the documents accompanying this release, as the case may be. The Company undertakes no obligation to publicly update or revise any forward-looking statements except as expressly required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.